Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Trump waved a 35% heavy hammer to Canada, and the Canadian dollar hit a new low

- The weekly line is high and the hammer head is high after short gold and silver

- The shooting star is waiting to fall, gold and silver continue to rise

- Only by breaking through 98.42 can you turn over? The long-short game between th

- Chinese live lecture today's preview

market analysis

Will the EUR/USD be retraceed to 1.14?

Wonderful introduction:

Since ancient times, there have been joys and sorrows, and since ancient times, there have been sorrowful moon and songs. But we never understood it, and we thought everything was just a distant memory. Because there is no real experience, there is no deep feeling in the heart.

Hello everyone, today XM Forex will bring you "[XM Group]: Will the Euro/USD be retreating to 1.14?". Hope it will be helpful to you! The original content is as follows:

On Tuesday (August 12), the euro/dollar remained at the key support level of 1.1600 and oscillated. US data showed that the Consumer Price Index (CPI) in July grew 2.7%, lower than market expectations of 2.8%. However, the annualized growth of core CPI was 3.1%, higher than the previous 2.9% and the market forecast of 3.0%.

This reflects the strong growth momentum of the US economy and the market's confidence in the US economic outlook is still relatively positive. The lower annual CPI growth rate may reduce the Fed's expectations of a rate hike, but the rise in core CPI shows that inflationary pressure remains, which may allow the Fed to maintain a more hawkish stance in future monetary policy.

The weakness in the euro zone economy has also exacerbated downward pressure on the euro/dollar. Data from Germany's ZEW economic sentiment survey in August showed that Germany's economic confidence declined more than expected, and the economic sentiment index fell from 52.7 to 34.7, far lower than the market's expectations of 40. This shows that the market's confidence in the future economic outlook continues to decline, and the risk of a slowdown in Europe is increasing. The general weakness in the euro zone's economic data, especially the decline in Germany, suggests that the euro zone's recovery is still facing challenges. The poor performance of Germany's economy may cause continued pressure on the euro against the dollar.

In addition, the Fed policy that the market is concerned about has not had a significant impact on the trend of the euro/dollar. The Fed's monetary policy will continue to be driven by data, and despite market responses to inflation data, the Fed's future actions remain crucial. If the Fed maintains a hawkish stance and further tightens monetary policy, it may push up the dollar and suppress the euro.

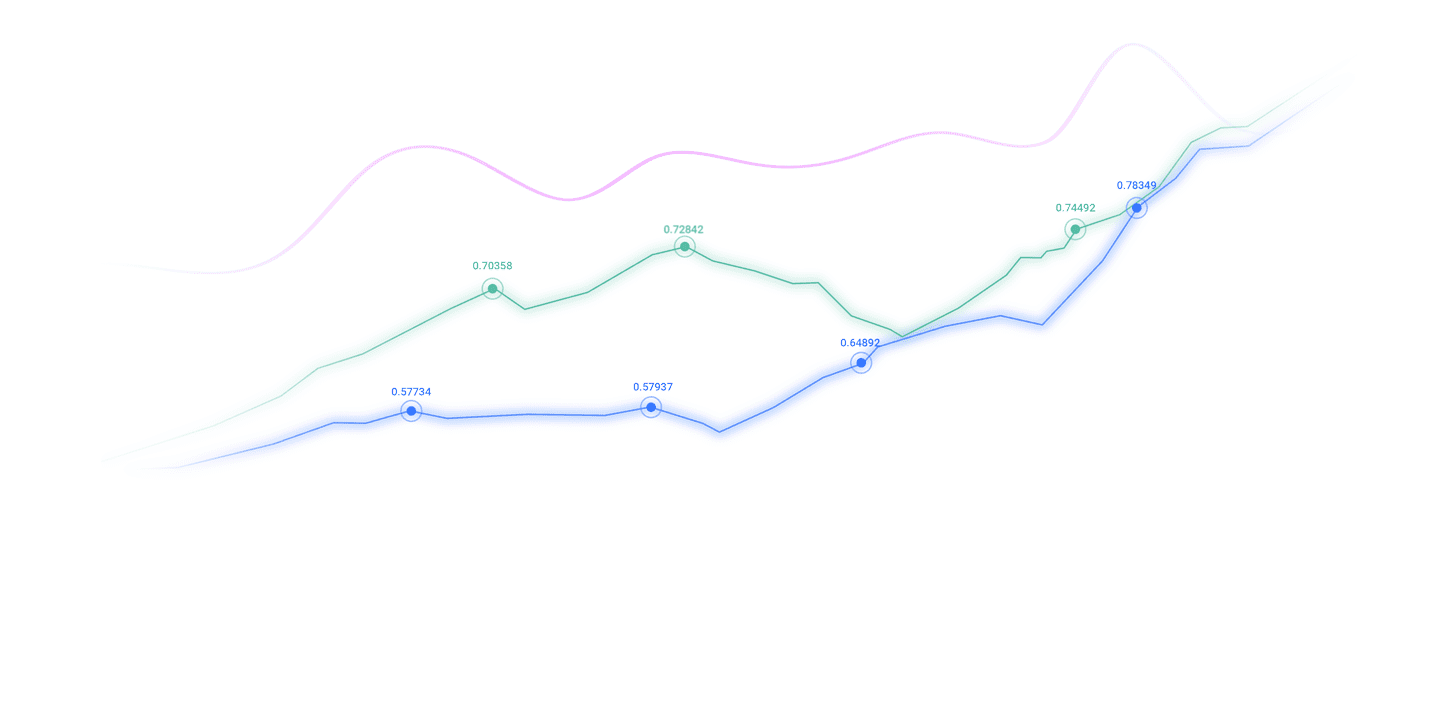

Technical Surface

Bollinger Band Analysis: From the FigureFrom the table, the www.xmspot.compression of the Bollinger bands shows that the market volatility is relatively low and the market is still in a relatively stable consolidation state. If the exchange rate falls below the lower track and fails to rebound effectively, it may further test a lower support level, such as 1.1500. On the contrary, if the price breaks through the upper track of the Bollinger band, it may usher in a stronger rebound signal.

MACD indicator: The current MACD line is still below the signal line, and the bar chart is also maintained in the negative value range. This signal indicates that the market is still weak and bears dominate. Although MACD does not show a significant reversal signal, the market is in the volatile range, and it is still necessary to pay attention to whether the golden cross pattern of MACD will appear, which usually indicates that the market may have a reversal signal.

RSI Analysis: The Relative Strength Index (RSI) is currently 50.87, showing that the market is sentiment neutral, with neither strong overbought nor oversold signals. The RSI is located near 50, which means that the market has no obvious direction. If the RSI breaks through 50 and moves upwards above 60, it may provide some support for the bulls. If the RSI falls below 50 and enters the oversold area, it may strengthen the market sentiment of the bears.

Support and resistance: The current support level of the EUR/USD is at 1.16. If the exchange rate breaks through this position downward, it may continue to fall to lower support areas, such as 1.1500 and 1.1400. The first resistance above is at 1.1684. If the exchange rate breaks through this resistance and stands firmly above it, it may usher in a further rebound, testing higher resistance levels of 1.1700 and 1.1750.

Future Outlook:

Bules Outlook: If the EUR/USD breaks through the resistance level of 1.1684 and successfully stands above it, the market will likely challenge the price 1.1700 and higher again. Current technical indicators indicate that the market may still have some upward action potential in the short term, especially before the release of the Federal Reserve's speech and economic data. If market sentiment turns more optimistic and U.S. economic data is below expectations, it may provide some support for the euro and drive upward testing of the exchange rate.

Bell Outlook: If the EUR/USD cannot break through the current resistance level and continues to remain below 1.1600, a further pullback may occur, and the price is expected to test the support level of 1.1500 or 1.1400. Considering the current www.xmspot.compression of the Bollinger Band, the market may be brewing a wave of large price fluctuations, so the risk of short operations still exists. If the European economy deteriorates further and the Fed continues to maintain a hawkish stance, bears may have a greater advantage, pushing the exchange rate further downward.

The above content is all about "【XM Group】: Will the Euro/USD be retreating to 1.14?". It was carefully www.xmspot.compiled and edited by the editor of XM Forex. I hope it will be helpful to your transactions! Thanks for the support!

Every successful person has a beginning. Only by having the courage to start can you find the way to success.Read the next article now!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here