Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Central Bank Differences, Data Games and Trade Easing, US Withdraws from Doha Ne

- 7.30 Analysis of the rise and fall trend of gold and crude oil today and the lat

- A collection of positive and negative news that affects the foreign exchange mar

- A collection of positive and negative news that affects the foreign exchange mar

- What is RWA? Can there be more gold?

market news

The shooting star is waiting to fall, gold and silver continue to rise

Wonderful introduction:

Spring flowers will bloom! If you have ever experienced winter, then you will have spring! If you have dreams, then spring will definitely not be far away; if you are giving, then one day you will have flowers blooming in the garden.

Hello everyone, today XM Foreign Exchange will bring you "【XM Group】: Shooting stars are waiting to fall, gold and silver continue to the sky." Hope it will be helpful to you! The original content is as follows:

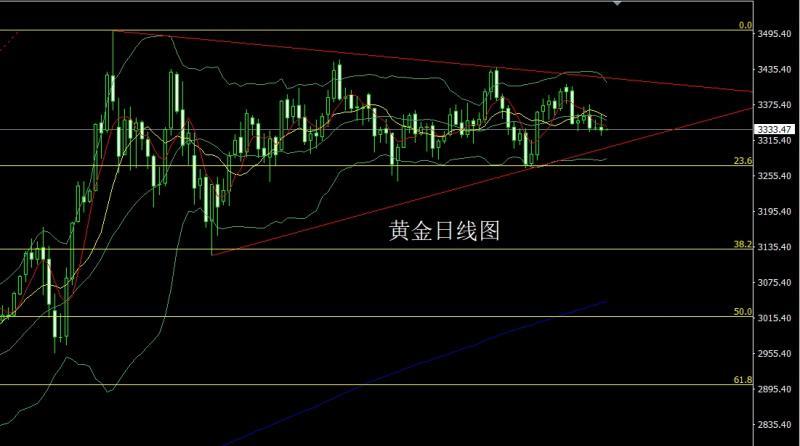

Yesterday, the gold market continued to fluctuate in range. After the opening in the early trading was at 3336.9, the market fell first. The daily line was at the lowest point of 3323.1, and the market reached the weekly level. The Bollinger mid-track support rose strongly. The daily line reached the highest point of 3358.4 and then the market surged and fell. The daily line finally closed at 3332.5. After the market closed with a shooting star with a very long upper shadow line. After this pattern ended, today's market was technically under pressure. At the point, the short position of 3354 yesterday was reduced and the stop loss followed at 3355. Today's market was 3348 short and conservative 3350 short and the stop loss was 3355. The target was 3330 and 3323. If it fell below, the 3312 and 3308 and 3302 support was mainly seen below.

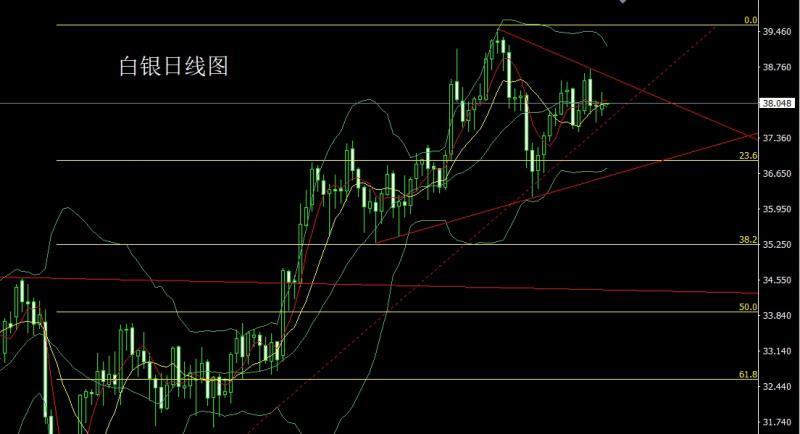

The silver market opened at 37.938 yesterday and the market fell first. The daily line was at the lowest point of 37.798 and then the market rose strongly. The daily line reached the highest point of 38.265 and then the market fell at the end of the trading session. The daily line finally closed at 38.013 and then the market closed in a spindle pattern with an upper shadow slightly longer than the lower shadow. After this pattern ended, it first pulled up today to give 38.2 short stop loss 38.4, with the targets 37.9 and 37.7, and fell below 37.5-37.3.

European and American markets opened at 1.17092 yesterday and the market first rose to 1.17150, and then the market fluctuated strongly. The daily line was given the lowest position at 1.16551 and then the market consolidated. After the daily line finally closed at 1.16608, the daily line closed with a mid-yin line with an upper and lower shadow line. Such a continuous www.xmspot.combination of yin and yang means that the market is currently having a severe difference between bulls and bears. At the point, today, 1.16950 short stop loss is 1.17150, and the target below is 1.16550 and 1.16300 and 1.16100.

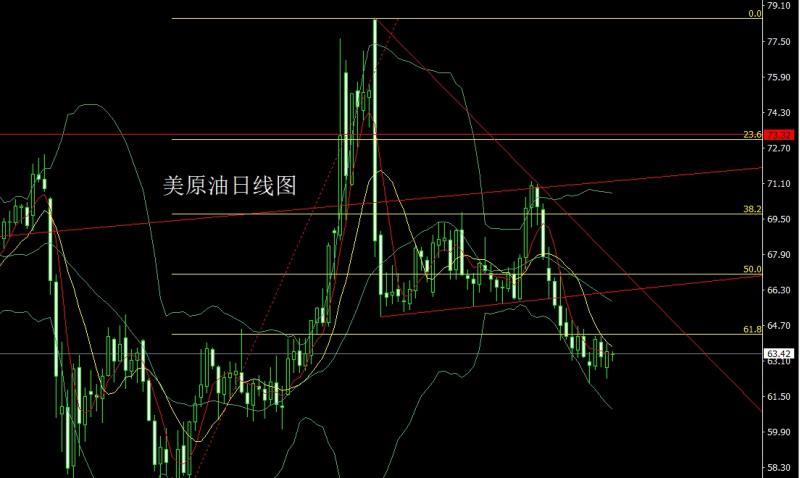

The US crude oil market opened lower at 62.8 yesterday and then first pulled up to 63.43, and then fell back strongly. The daily line was at the lowest point of 62.3, and then the US market rose strongly in the intraday stage. The daily line reached the highest point of 63.88 and then the market consolidated. The daily line finally closed at 63.5, and then the market closed with a medium-positive line with an upper and lower shadow line. After this pattern ended, today's market continued to consolidate at low box. At the point, it fell back to 62.65 and 62.2 today, with the targets looking at 63.5 and 63.8-64.2.

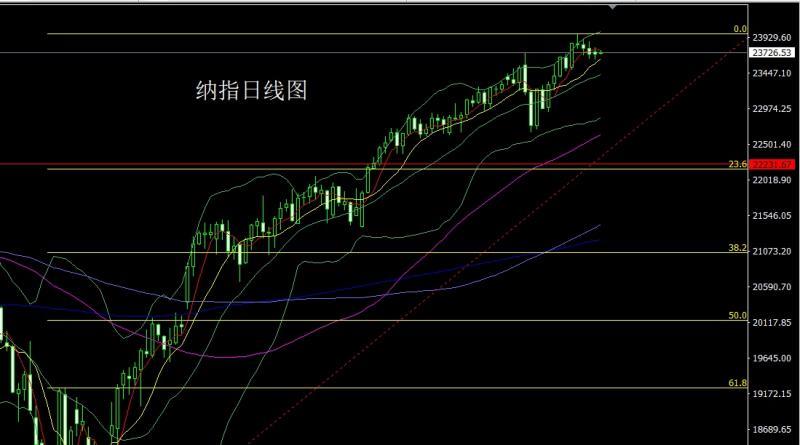

Nasdaq index market opened at 23731.58 yesterday and then the market first rose to 23794.24. Then the market fell. The daily line was at the lowest point of 23627.15 and then the market rose at the end of the trading session. The daily line finally closed at 23700.25. Then the market closed with a spindle pattern with an upper and lower shadow line. After this pattern ended, there was pressure to fall today. At the point, the short position of 23860 last Friday was reduced and the stop loss followed at 23900. Today, the target of 23850 short stop loss was 23650, and the target below 23600 and 23550-23500 fell.

The fundamentals, yesterday's fundamentals, the confidence index of the US housing builder fell to two and a half years low. , while the U.S. President at the White House informed the Ukrainian president that he and the Russian president talked about the content of the peace agreement in Alasky, and said that he had begun to arrange a meeting between Putin and Zelensky, with the location to be determined. After that, the three-sided meeting will be held. Today's fundamentals mainly focus on the annualized total number of new houses in the United States in July and the total number of construction permits in July.

In terms of operation, gold: yesterday's short position reduction of 3354, the stop loss followed by 3355, the market today is 3348, the short position conservative 3350, the short stop loss 3355, the target is 3330 and 3323, if it falls below, the bottom mainly looks at 3312 and 3308 and 3302 support.

Silver: Today, it will first raise and give 38.2 short stop loss 38.4, the target is 37.9 and 37.7, falling below 37.5-37.3.

Europe and the United States: 1.16950 short stop loss today 1.17150, the target below is 1.16550 and 1.16300 and 1.16100.

U.S. crude oil: Today, it fell back to 62.65 long stop loss 62.2, the target target is 63.5 and 63.8-64.2.

Nasdaq: Last Friday, the short position of 23860 was reduced and the stop loss followed at 23900. Today, the target below 23850 short stop loss 23900 was 23650, and the target below is 23600 and 23550-23500.

Yesterday 3354-3356 short

The above content is all about "【XM Group】: Shooting stars are waiting to fall, gold and silver continue to the sky". It was carefully www.xmspot.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Life in the present, don’t waste your current life in missing the past or looking forward to the future.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here