Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The US-Japan trade agreement shocks the world! Trump announces new 15% tariff po

- Guide to short-term operation of major currencies on July 28

- Trump stresses that Europe stops buying Russian oil, investors take profits to l

- What's wrong with the euro? European Chemical Industry is trapped in a double ki

- Powell's remarks curb market expectations for a rate cut in September, with gold

market analysis

Powell's speech becomes key, the direction of the dollar is about to be revealed

Wonderful introduction:

Spring flowers will bloom! If you have ever experienced winter, then you will have spring! If you have dreams, then spring will definitely not be far away; if you are giving, then one day you will have flowers blooming in the garden.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Review]: Powell's speech becomes the key, and the direction of the US dollar will be announced soon." Hope it will be helpful to you! The original content is as follows:

On Wednesday (July 30), the US dollar index temporarily stopped after four consecutive days of rising, and trading around the 98.80 line during the European period showed a high consolidation trend. Global market sentiment has become cautious and the wait-and-see atmosphere is strong, and traders generally focus on the Fed's interest rate meeting. The CMEFedWatch tool shows that the market is almost sure that this meeting will keep interest rates unchanged, with the probability of maintaining them in the range of 4.25% to 4.50% as high as 97%. However, what the market really cares about is not the resolution itself, but the guidance on the future monetary policy path that Federal Reserve Chairman Powell may release in the post-conference press conference.

French fundamentals

The current driving force of the US dollar trend mainly www.xmspot.comes from two aspects: one is the market's game over the direction of the Federal Reserve's policy, and the other is the risk aversion demand brought about by external macro uncertainty. Although the US labor market is still resilient, the recent inflation data and economic growth indicators have performed differently, which has intensified the market's expectations of future economic paths. In particular, the upcoming Q2PCE price index and July non-farm employment data will become an important signal to evaluate whether the US economy has "soft landed".

On the political level, the pressure from the US government on the Federal Reserve is also a variable that interferes with market pricing. President Trump once again publicly criticized Fed Chairman Powell. Although the market generally expects no recall action, such remarks still cast a shadow on the Fed's independence and pose a potential threat to the US dollar's medium- and long-term credibility.

In Europe, the new trade agreement between the United States and the European Union injects some optimism into the market. Under the interweaving of multiple variables, the US dollar index is at a critical crossroads. If Powell's speech in the early morning deviates from market expectations, it is expectedIt will cause severe price fluctuations.

Technical:

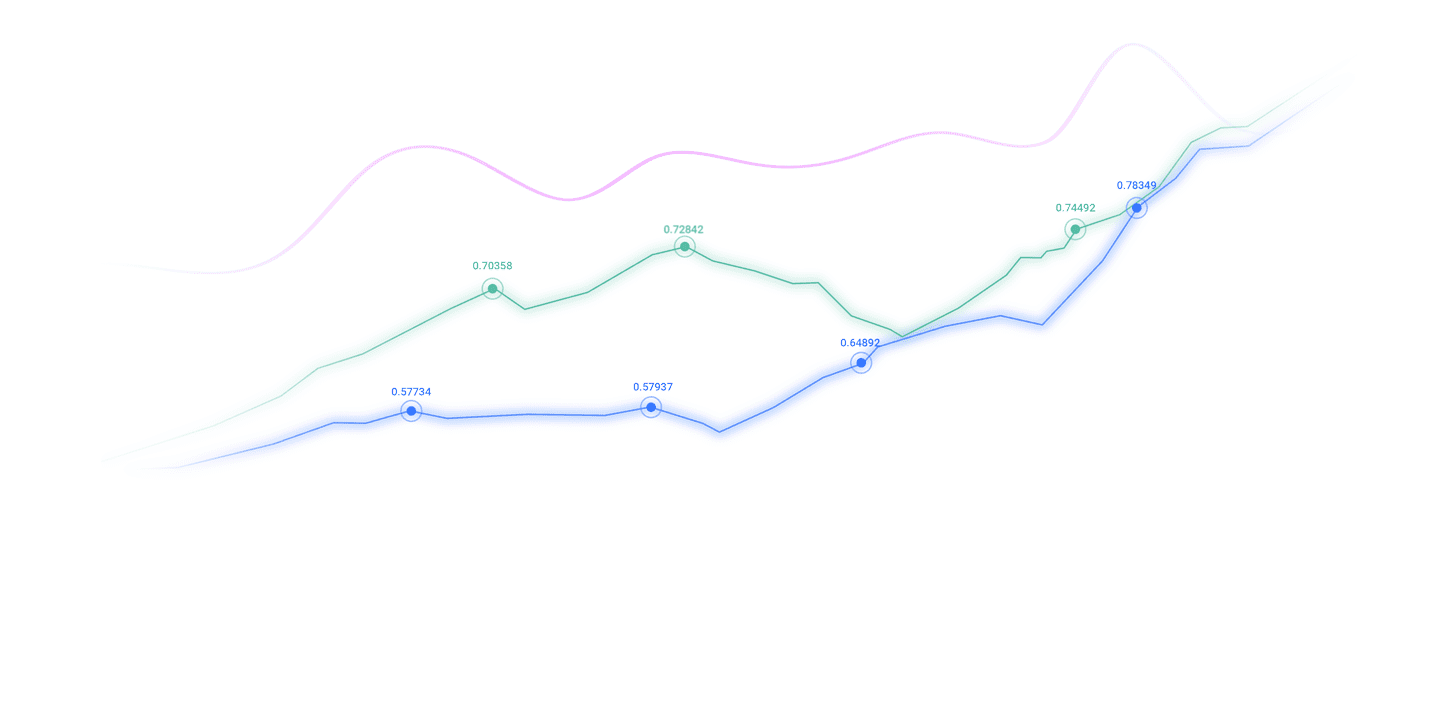

The US dollar index is currently located near 98.80, and the trend rebounded from the low point of 96.37, reaching a maximum of 99.14, but it encountered resistance and fell back when it approached the integer mark of 100.00, reflecting that there is significant selling pressure above this position.

From the K-line structure, the bulls' upward momentum is blocked, and there is pressure to take profits in the short term. However, the overall structure has not yet destroyed the rebound trend, and the price is still between the middle rail of the Bollinger band (97.72) and the upper rail (99.04). The Bollinger band remains slightly open, reflecting that it is currently in a strong oscillation pattern.

In terms of MACD indicators, the DIFF line continues to rise from below the zero axis, and the MACD bar chart has expanded since late July, indicating that the short-term momentum has turned from idle to long. However, the current MACD indicator is close to the previous high. If the evening event drive is less than expected, you need to be vigilant about the risk of short-term pullbacks.

The RSI indicator is located near 58.4 and has not yet entered the overbought area and still has further upward action potential, but it also implies that the bulls are facing a critical zone and the market urgently needs new catalysts to www.xmspot.complete the breakthrough of the 100 mark.

Technical structure analysis believes that 99.14 and integer digit 100.00 constitute the key resistance range above. If it can break through in large volume, it is expected to challenge 101.00 again; the lower support level is focused on 97.92 and Bollinger band lower track 96.38. Once it falls below the latter, it will constitute a phased trend reversal signal.

Previous observation of market sentiment:

The market is currently in a state of "silence before news", and risk preferences are significantly converging. Traders are generally unwilling to make heavy bets before the FOMC results are announced, reflecting a typical event-driven waiting market.

The fear and greed index has not shown obvious extremes, reflecting that the market has not yet formed a consistent expectation and strong wait-and-see sentiment for funds. The role of the US dollar as a global liquidity anchor makes it attractive against the current background of "interest rate expectations are uncertain + international uncertainty continues", so the US dollar's decline is limited.

But it is worth noting that if the Fed's attitude changes, coupled with the increase in pressure on it by the White House and the heating of international uncertainty, the US dollar's safe-haven position may be challenged, which will trigger a rapid turn in market sentiment.

The above content is all about "[XM Foreign Exchange Market Review]: Powell's speech becomes the key, and the direction of the US dollar is about to be announced". It was carefully www.xmspot.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not qualified to fail, but are born to be conquered. Step up to learn the next article!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here