Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The triple negative pressure is over, and the plunge of 0.6% is just the beginni

- Australian dollar/USD rises further due to new risk preference

- A collection of positive and negative news that affects the foreign exchange mar

- The dollar index is weak, the market is waiting for Powell to speak

- Chinese online live lecture this week's preview

market analysis

The US dollar stabilizes, and Trump nominates key figures in the Federal Reserve! Gold suddenly rumored to be levied on tariffs

Wonderful introduction:

Without the depth of the blue sky, there can be the elegance of white clouds; without the magnificence of the sea, there can be the elegance of the stream; without the fragrance of the wilderness, there can be the emerald green of the grass. There is no seat for bystanders in life, we can always find our own position, our own light source, and our own voice.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Platform]: The US dollar stabilizes, Trump nominates a key figure in the Federal Reserve! Gold is suddenly rumored to be subject to tariffs." Hope it will be helpful to you! The original content is as follows:

Earlier on Friday, the US dollar remained flexible against other currencies, and the US dollar index stabilized above 98.00. The U.S. Economic Calendar will not release any macroeconomic data that has a greater impact, allowing investors to continue to pay attention to www.xmspot.comments from Fed officials over the weekend. Later that day, Statistics Canada will release employment data for July.

The U.S. dollar index fell slightly on Thursday, with the pound/dollar rising after the Bank of England (BoE) incident, indicating that the pound absorbed capital outflows from the U.S. dollar. The Bank of England announced after its August meeting that it would cut its policy interest rate by 25 basis points (bps) as expected. After the second round of voting, policymakers voted 5-4 in favor of rate cuts, while the market expected only two officials to vote for the silence. At a post-conference press conference, Bank of England Governor Andrew Bailey said it is important that they do not lower policy rates too quickly or too much. The GBP/USD rose more than 0.6% on Thursday, hitting its highest level since July 28, breaking through 1.3400. Earlier on Friday, the pair consolidated weekly gains, trading at just below 1.3450.

Meanwhile, Bloomberg reported late Thursday, citing an unnamed source that Fed governor Christopher Waller voted for a 25 basis point rate cut at a July meeting, becoming the leading candidate to succeed Fed Chairman Jerome Powell. According to reports, US President Donald Trump plans to announce the news at the end of the summer.

Basic market conditions of the foreign exchange market:

Euro/USD continued to rise slightly on Thursday after rising Wednesday, but it was difficult to maintain bullish momentum. After hitting 1.1700, the euro/dollar correction fell and closed almost flat. Earlier on Friday, the euro/dollar consolidated sideways around 1.1650.

During Friday, the US dollar/JPY is still in the consolidation phase above 147.00. Japanese trade envoy Ryoseki Akazawa said on Friday that the United States has agreed to correct the president's order on tariffs and refund any excess tariffs that were wrongly charged. Akazawa added that there was no disagreement between the United States and Japan on the issue of reciprocity tariffs.

The USD/CAD is still under moderate bearish pressure, with European trading below 1.3750 in early trading. Unemployment rate is expected to rise slightly to 7% in July from 6.9% in June.

Bulle market fundamentals:

In terms of www.xmspot.commodities, Brent crude oil futures remained flat at $66.45 per barrel, while U.S. crude oil futures changed slightly, at $63.81.

The Financial Times quoted a letter from the U.S. Customs and Border Protection that the United States has imposed tariffs on imports of 1 kilogram of gold bars, which account for most of Switzerland's gold exports to the United States. New York gold futures hit an all-time high, with spot gold falling 0.1%, the latest at $3,393.

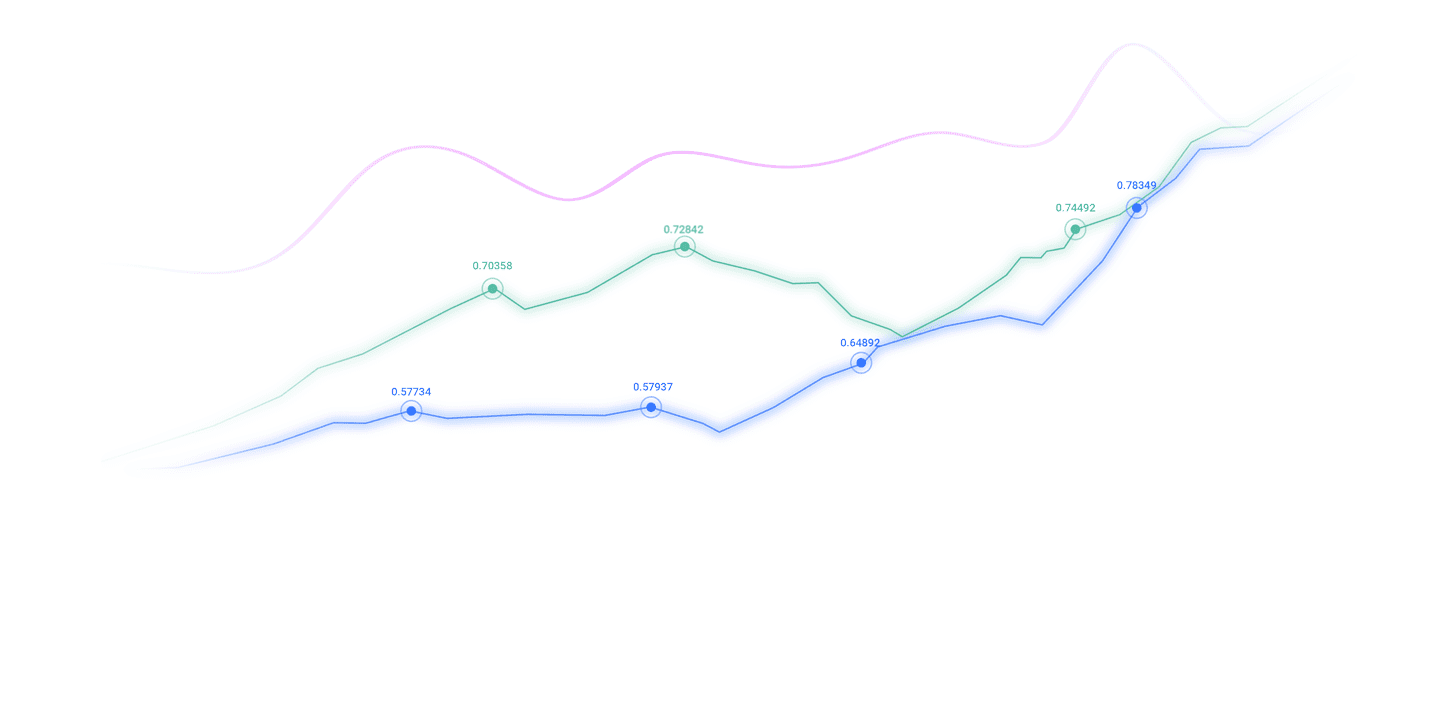

Analysis of major currency trends:

Euro: The intraday bias of the euro/dollar remains moderately upward. As mentioned earlier, the correction starting from 1.1829 should be www.xmspot.completed when the three waves drop to 1.1390. Further rebound will retest the 1.1788/1820 resistance zone. However, on the downside, breaking through the 1.1526 small support level will weaken this view and retest 1.1390.

The above content is about "[XM Foreign Exchange Platform]: The US dollar has stabilized, Trump nominates a key figure in the Federal Reserve! The entire content of gold suddenly rumored to be levied on tariffs was carefully www.xmspot.compiled and edited by the editor of XM Forex. I hope it will be helpful to your transaction! Thank you for your support!

Every successful person has a start. Only by being brave enough to start can you find the way to success. Read the next article quickly!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here