Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The US dollar strengthened slightly but weekly pressure, Fed personnel changes a

- By selecting the next Fed chairman, how can Trump "released" and put pressure on

- Powell's speech is imminent, analysis of short-term trends of spot gold, silver,

- US withdraws from Doha negotiations, Trump visits the Federal Reserve, safe-have

- The dollar index fell and the Fed's expectation of a higher rate cut, supporting

market analysis

Bank of Japan's interest rate hikes heat up, USD/JPY is aiming at the 149 mark

Wonderful introduction:

Optimism is the line of egrets that are straight up to the blue sky, optimism is the ten thousand white sails beside the sunken boat, optimism is the lush grass that blows with the wind on the head of the parrot island, optimism is the falling red spots that turn into spring mud to protect the flowers.

Hello everyone, today XM Forex will bring you "[XM Group]: The Bank of Japan's interest rate hikes heat up, the US dollar/yen point to the 149 mark." Hope it will be helpful to you! The original content is as follows:

Japan inflation data in July was slightly higher than expected, further triggering speculation that the Bank of Japan (BOJ) might raise interest rates as early as October. Although the yen has performed weakly recently, as Fed policy expectations turn dovish and Bank of Japan's austerity policy approaches, the market holding structure and macro momentum may usher in a change. Currently, the US dollar/JPY is still fluctuating at a high level near the key resistance level, but from a long-term perspective, the yen is expected to strengthen in the fourth quarter.

Line charts and bar charts show the national inflation trend in Japan. In July 2025, Japan's overall consumer price index (CPI) rose 3.1% year-on-year, and the core CPI (excluding fresh food and energy) stabilized at 1.6% year-on-year. The chart shows that the current inflation level is stable above the pre-epidemic level, providing support for speculation that the Bank of Japan has raised interest rates in October. Monthly CPI data also shows that the price pressure of core categories continues to stabilize.

Expectations of Bank of Japan's interest rate hikes have heated up, and the US dollar/yen approaches resistance level

Japan inflation data is slightly higher than market expectations, but it may not necessarily prompt the Bank of Japan to raise interest rates immediately. The national CPI rose 3.1% year-on-year, just slightly higher than the expected value of 3.0%, and lower than the increase of 3.3% in June. The core core CPI (excluding fresh food and energy) has been stable at 1.6% year-on-year for four consecutive months, but it rose by 0.2% month-on-month in July.

www.xmspot.combined with Japan's strong GDP growth and a trade agreement restarted with the United States, a Reuters survey showed that economists increasingly support the Bank of Japan's interest rate hikes by 25 basis points in the fourth quarter, with October being considered the most likely time for policy tightening.

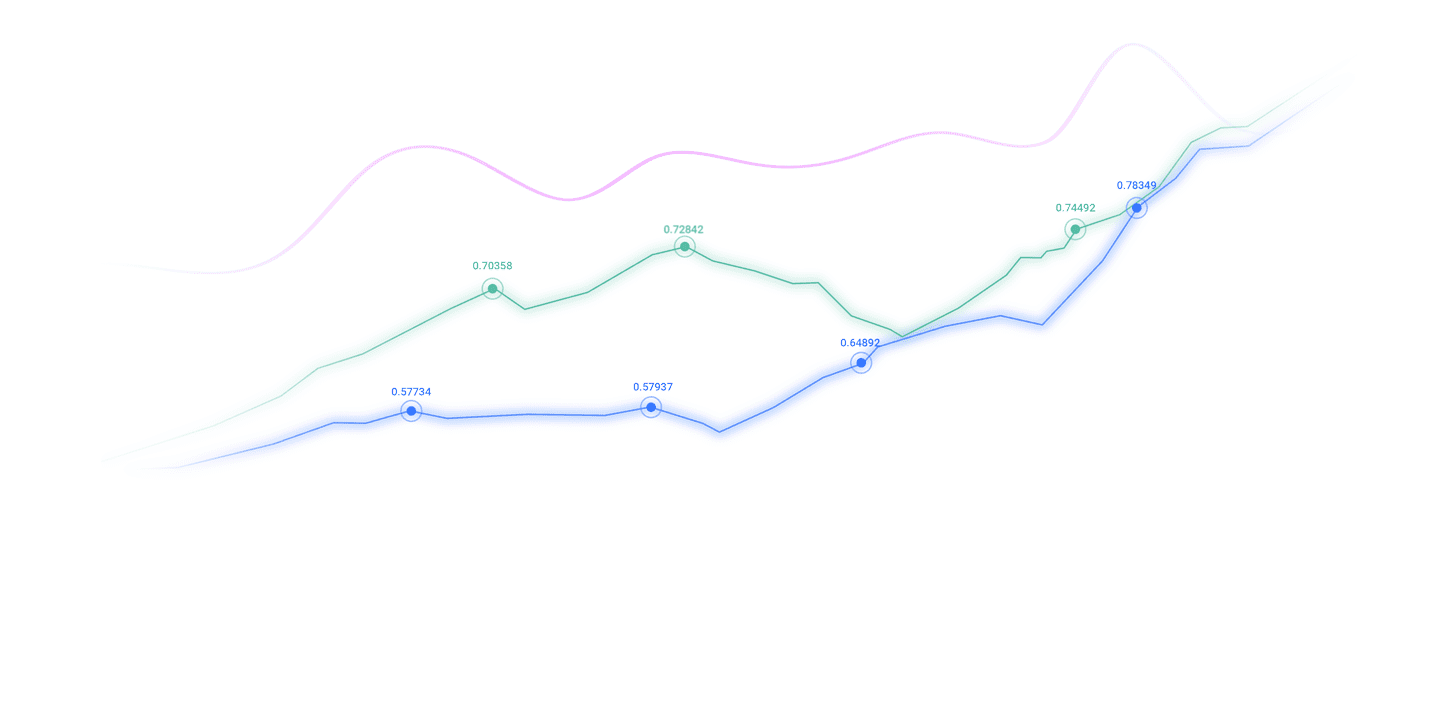

JPYYL Futures (JYc1): Position Report (COT) Analysis

The yen has continued to weaken against the US dollar since early April (USD/JPY is showing a long trend), which is also reflected in the Trader Position Report (COT) data. Large speculators and asset managers have been reducing net long exposure to yen futures, driven by an increase in net short positions and a decline in net long positions.

This change in holdings coincides with the cooling of market expectations for the Bank of Japan's short-term tightening. However, as the fourth quarter approaches, the yen bulls may begin to become active again. In fact, the yen net long positions of large speculators had seen a slight increase last week, and the overall net long positions remained intact.

Looking forward, I expect the market trend to shift to a direction that is not conducive to the US dollar and the Japanese yen before the end of the year. This will drive the US dollar/yen lower, especially as the Fed turns dovish and the Bank of Japan may implement a 25 basis point rate hike. Nevertheless, given the current momentum is still biased towards the US dollar/JPY upward, the shorts of the yen may still dominate in the short term.

Yen Outlook Outlook

In the short term, the US dollar/JPY seems to be the most attractive trading type for yen shorts. The dollar is still a market-favorable currency, especially if Federal Reserve Chairman Powell sends a hawkish signal in his speech at Jackson Hall later today (as opposed to market expectations for a dovish turn).

Dollar/JPY Technical Analysis

Daily chart shows that the USD/JPY shows a fluctuating but overall bullish trend, characterized by a series of gradually rising lows (although the trend is slightly irregular). The bullish engulfing pattern that appeared on Thursday showed that an upward breakthrough could be www.xmspot.coming, with the 150.00 mark becoming the focus. If the level is exceeded, the bulls may point to the August high of 150.92 and the March high of 151.30.

Nevertheless, considering the bearish signals on the weekly chart, if the price approaches the above high, the bulls should remain cautious.

The rebound market, which started in September and December lows, seemed to have a correction nature after a sharp drop in January highs. In addition, a long upper shadowed "meteor line" pattern was formed three weeks ago, with its high point slightly lower than its March peak. So, although I have a short-term bullish view on the USD/JPY at the daily level, I am still paying close attention to the potential top pattern that may form below the 151 mark.

The above content is all about "[XM Group]: The Bank of Japan's interest rate hike expectations heat up, the US dollar/yen point to the 149 mark". It was carefully www.xmspot.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

After doing something, there will always be experience and lessons. In order to facilitate future work, we must analyze, study, summarize and concentrate the experience and lessons of previous work, and raise it to the theoretical level to understand it.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here