Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Worries about supply disruption heat up WTI crude oil rises by more than 1.5%, b

- The US and Japan finalize huge trade agreement but leave car tariff suspense, Pr

- After gold hits a new high, 3466 gains and losses determine short-term strength

- Jackson Hole Annual Meeting Releases Dove Signal, U.S. Treasury Yield Curve Is S

- 7.22 When will the strong bulls in gold fall? The latest operating suggestions a

market news

PMI is positive but the yen falls, and the Japanese economy hides "fatal loopholes" and sounds the alarm for global stock markets

Wonderful introduction:

A person's happiness may be false, and a group of people's happiness cannot tell whether it is true or false. They squandered their youth and wished they could burn it all, and that posture was like a carnival before the end of the world.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Analysis]: PMI is positive but the yen has fallen, and the Japanese economy has hidden a "fatal loophole", which sounds the alarm for global stock markets." Hope it will be helpful to you! The original content is as follows:

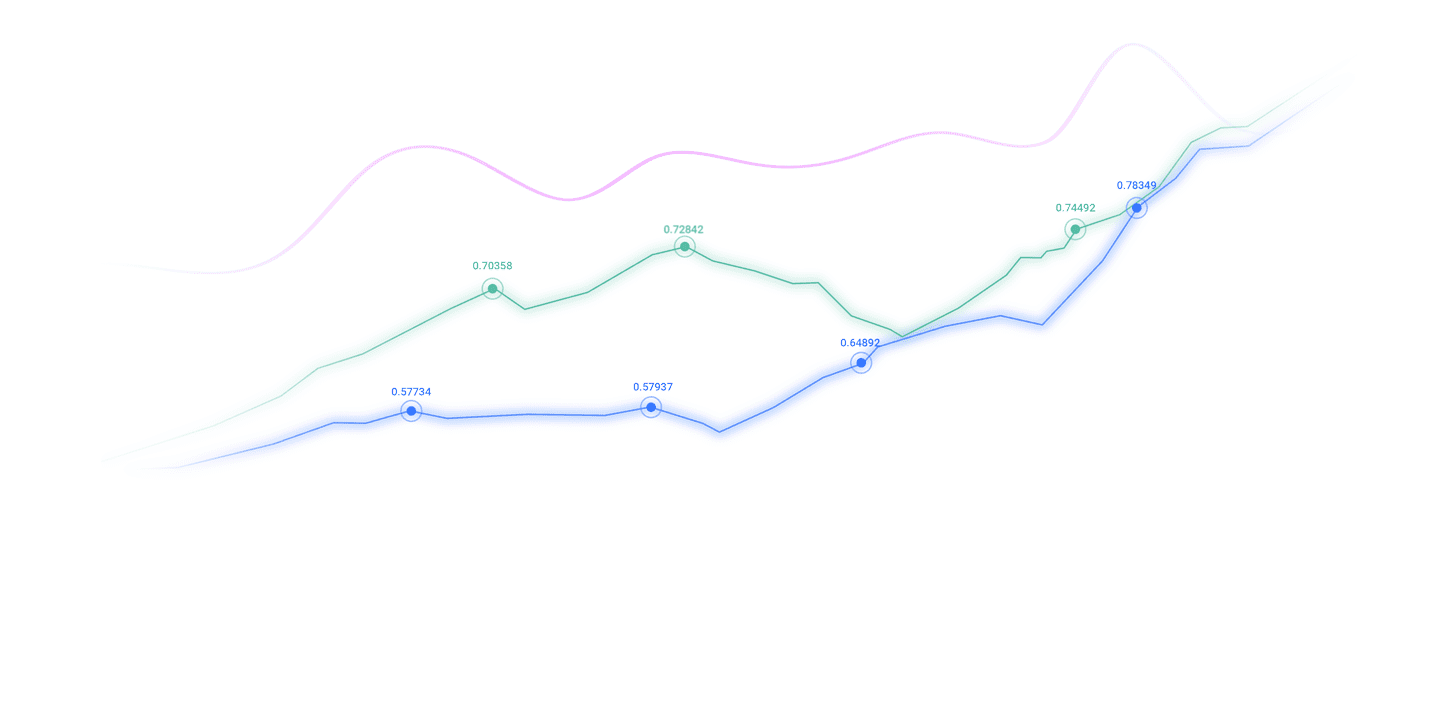

XM Foreign Exchange APP News--The yen fluctuated and fell during the Asian and European period on Thursday (August 21); the exchange rate of the US dollar against the yen is between 147.25-147.63, currently up 0.17%, trading around 147.55. Except for the US's exceeding expectations for August, the U.S. PMI data showed that Japan's (mainly private) businesses became better in the middle of the third quarter, with the fastest expansion since February. This is mainly because factory production has recovered, and the service industry has maintained a good expansion momentum: factory output has grown for the second time in three months. Although the service industry has expanded a little slower than last month, it is still developing steadily. Overall, the new business volume has grown the fastest in six months, but the differences between different industries are obvious: only new orders in the service industry are increasing, which is the only driving force for growth; new orders in the manufacturing industry are still decreasing, but the reduction is smaller than in July. It should be noted that foreign demand for Japanese goods and services has declined for five consecutive months. Whether it is factory products or service services, export orders have decreased significantly, indicating that current economic growth is mainly supported by domestic demand. (Japan www.xmspot.comprehensive PMI and manufacturing PMI trend chart, where the manufacturing PMI is orange) The cost of enterprises is rising rapidly, but the selling price is rising slowly, making money even harder. In August, the costs of enterprises (such as purchasing raw materials, paying wages, fuel and transportation) are rising faster and faster. Although the increase is lower than the historical average, the growth rate is significantly faster, and the increase in raw materials, labor, fuel and transportation costs are the main reasons. By industry, the cost increase in the service industry has been faster than that of manufacturing in the first half of the year. This situation of different cost pressures in different industriesThe situation continues. In sharp contrast to the rapid rise in costs, the selling price of corporate products or services has increased even slower for two consecutive months, with the lowest increase in August since October 2024. Because the market www.xmspot.competition is too fierce and customers require discounts, www.xmspot.companies cannot raise their selling prices at will. The costs rise quickly and the selling prices rise slowly. This means that the profit margin of the www.xmspot.company will be further www.xmspot.compressed and making money is even more difficult. Enterprises are not very brave to recruit people, but they cannot www.xmspot.complete orders, so they are generally cautious in recruiting people. They only recruit a little more people in August; but at the same time, the number of unfinished orders increased at the fastest rate since June 2023, indicating that the www.xmspot.company's production capacity is a bit unable to keep up with demand, and there is a mismatch in supply and demand. For the business outlook for the next year, the www.xmspot.company's optimism in August is slightly higher than in July, but still lower than the past average. This shows that under the uncertainty of domestic and foreign demand, www.xmspot.companies are still cautious about whether growth can continue. Expert interpretation Annabel Fidds, deputy director of global market intelligence economy, said, "August data showed that the overall growth momentum of enterprises rebounded, and the output growth rate was the highest in six months, especially the expansion of manufacturing and services, which is worth paying attention to. But manufacturing sales have been declining, which reminds us that if demand does not improve in the short term, the production recovery of manufacturing may be difficult to sustain." "The current growth mainly depends on domestic demand, and the weak foreign demand has not changed. Costs have accelerated, and www.xmspot.companies cannot raise the selling price accordingly. This double pressure will further www.xmspot.compress the profit margins of enterprises, and this issue needs to be paid attention to." Japan's exports to Europe are showing a downward trend. In July 2025, Japan's exports to the EU fell by 3.4%, of which steel exports plummeted by 53.1%. Behind this may be that Europe's own economic development faces some problems, such as exports of major economies such as Germany and Italy suffered a setback in the second quarter, which lowered

The above content is about "[XM Foreign Exchange Market Analysis]: PMI is positive but the yen fell, and the Japanese economy has hidden a "fatal loophole" and sounded the alarm for global stock markets". It was carefully www.xmspot.compiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Every successful person has a beginning. Only by having the courage to start can you find the way to success. Read the next article now!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here