Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The "muzzle" of economic data is more difficult to resolve than political pressu

- On the ultimate decisive day, tonight's employment data set the market direction

- With the arrival of US retail data, can the US dollar counterattack again?

- Gold, 3355 continues to be empty!

- The US dollar against the yen peaked? Technical structure suggests that reversal

market news

Gold lacks bullish confidence amid amid a reduction in Fed's rate cut bets and hopes of peace

Wonderful Introduction:

A quiet path will always arouse a relaxed yearning in twists and turns; a huge wave, the thrilling sound can be even more stacked when the tide rises and falls; a story, only with regrets and sorrows can bring about a heart-wrenching desolation; a life, where the ups and downs show the stunning heroism.

Hello everyone, today XM Forex will bring you "[XM Forex Decision Analysis]: Gold lacks bullish confidence in the context of the reduction of interest rate cut bets and hope for peace." Hope it will be helpful to you! The original content is as follows:

On Tuesday (August 19), spot gold attracted buying on dips, leaving the two-week lows hit the previous day. It is currently trading around $3,336/ounce, up 0.11% from the previous day's closing price of 3,333.73, fluctuating narrowly. The market generally expects the Federal Reserve to restart its interest rate cut cycle in September, which has become a key factor in supporting spot gold. In addition, cautious market sentiment has also driven some safe-haven funds to flow to gold.

At the same time, the dollar is trying to continue the previous day's rise as market expectations for the Fed's radical easing cooled. On the other hand, hopes of a peace agreement between Russia and Ukraine may limit gold gains. Gold bulls may choose to wait for the minutes of the Fed meeting released on Wednesday, and Fed Chairman Powell's speech at the Jackson Hall seminar.

Market Trends: Gold benefits from the Federal Reserve's upcoming interest rate cut in September

After the release of US PPI data in July last Thursday (the fastest month-on-month growth rate since 2022), traders have cut their bets on the Fed's sharp interest rate cut in September. In addition, preliminary data from the University of Michigan on Friday showed that the U.S. 1-year inflation expectations rose from 4.5% to 4.9%, and the five-year expectations rose from 3.4% to 3.9%.

These data indicate that price pressure is accelerating and strengthen the reason for the Federal Reserve to maintain a hawkish stance, which in turn constitutes a negative for spot gold. However, the market still expects the probability of a rate cut in September to be close to 85%, and there are at least two 25 basis points cuts this year, which has curbed the US dollar's gains and provided support for gold.

S&P Global Ratings confirm that the US sovereign credit rating is "AA+/A-1+" maintains a "stable" outlook. The agency pointed out that due to the growth of structural interest expenditures and the rise in aging-related expenditures, the ratio of US government net debt to GDP will approach 100%, and the fiscal deficit will not improve substantially in the short term, but will not continue to deteriorate in the next few years.

In terms of geopolitical aspects, Russian President Putin agreed to hold a peace summit with Ukrainian President Zelensky, and the Russian-Ukrainian conflict has a bright future, which may limit the rise of safe-haven gold. Traders may wait for more clues to the Fed's interest rate cut path before laying out new directions.

The market focus will turn to the minutes of the Federal Reserve's meeting released on Wednesday and Powell's speech at the Jackson Hall seminar. In addition, Thursday will be published. The initial PMI data released will also provide new evidence of global economic health, which may lead to fluctuations in gold prices.

Housing data such as the National Association of Housing Builders (NAHB) real estate market index on Tuesday had limited impact on gold prices, but the remarks of Fed officials may drive changes in demand from the dollar, www.xmspot.combined with overall risk preferences, or create short-term trading opportunities for gold.

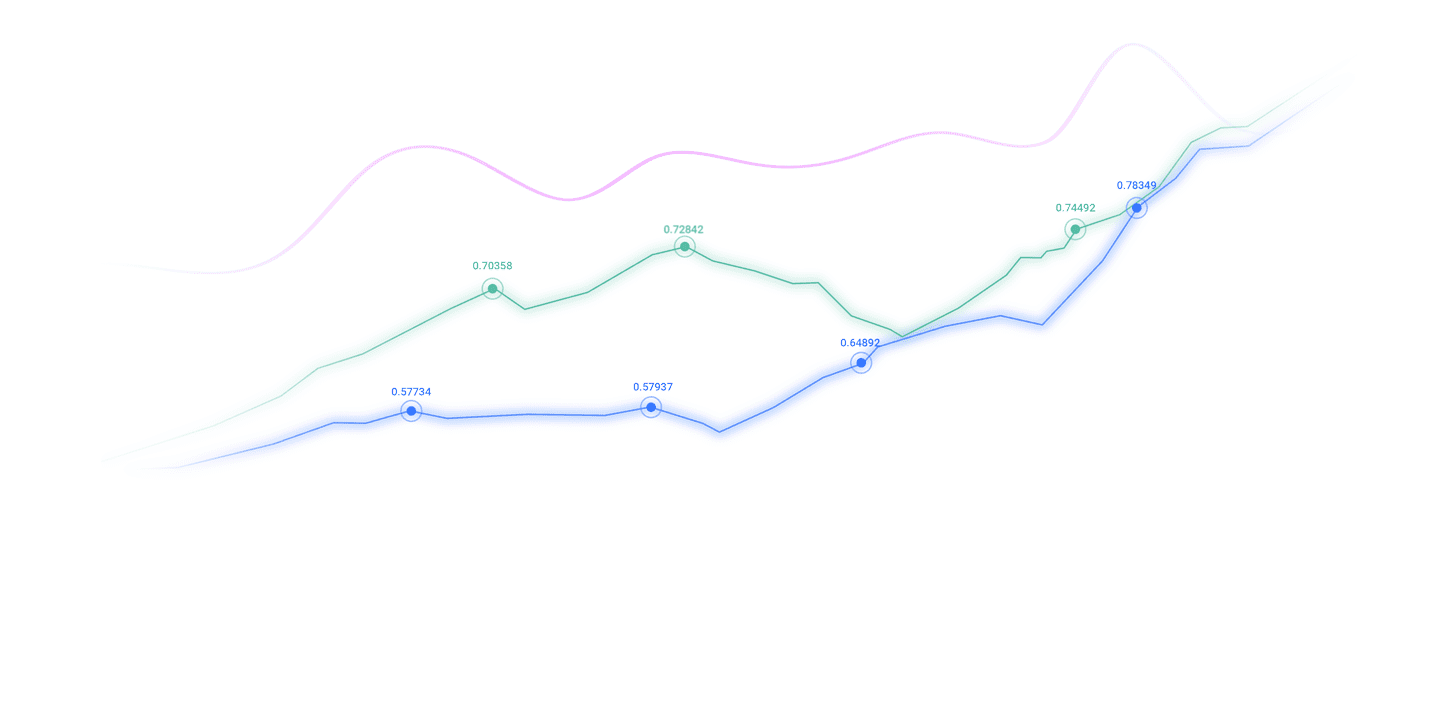

Gold may face strong resistance near the 200-period moving average on the four-hour chart, which is currently ahead of the $3350 mark.

From a technical perspective, the 4-hour chart indicator is slightly negative, which requires bulls to remain cautious, or adjust the position layout of the recent sharp rise. Therefore, after the gold price, Any upward trend may face strong resistance near the 100-period simple moving average (SMA) on the 4-hour chart, which is currently cut in the range of $3347-3348. If you break through, you need to pay attention to the overnight swing high of $3358. After the continued break, spot gold may further challenge the $3372-3374 area. If the upward trend can continue, gold prices are expected to re-establish the $3400 integer mark and then test this month's peak of $3408-3410 area.

In terms of downward trend, the $3325-3323 area (i.e., the two-week low hit on Monday) is expected to provide initial support. After falling below the $3310-3300 key range. If it is determined to fall below this branch Support belt, spot gold may accelerate its downward reaching the horizontal support level of US$3283-3282, and then test the swing low at the end of June of $3268 - this position is also the lower track of the trading range in the past three months. Effective breakdown will provide new trading momentum for shorts.

The above content is about "[XM Foreign Exchange Decision Analysis]: In the context of the reduction of interest rate cut bets and the hope of peace, gold lacks bullish confidence" is carefully www.xmspot.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for your support!

Only the strong understand the struggle; the weak are not qualified to fail, but are born to be conquered. Step up to learn the next article!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here