Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Multi-factor hedging, the US dollar against the Canadian dollar is tangled with

- Japanese bond yields approached a new high, analysis of short-term trends of spo

- Trading cautiously before the Fed's Beige Book was released, with the US dollar/

- Bank of Japan suggests that the conditions for interest rate hikes are gradually

- Multiple data bearish US dollar, gold prices fall below two-week high intraday t

market analysis

Whoever is elected as the next Fed chairman will choose to intensively cut interest rates

Wonderful Introduction:

Life is full of dangers and traps, but I will never be afraid anymore. I will always remember. Be a strong person. Let "strong" set sail for me and always accompany me to the other side of life.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Decision Analysis]: No matter who is elected as the next Federal Reserve Chairman, he will choose to intensively cut interest rates." Hope it will be helpful to you! The original content is as follows:

XM: No matter who is elected as the next Federal Reserve Chairman, he will choose to intensively cut interest rates.

XM Exchange www.xmspot.comment: Under Trump's high pressure, cracks are appearing within the Federal Reserve. Earlier this month, Federal Reserve Director Kugler resigned for unknown reasons, absent from the Federal Reserve's interest rate decision on July 31 and left the Federal Reserve on August 8. The official only gave an explanation of "personal reasons", but outside speculated that Kugler might have resigned because of disagreement with Chairman Powell. After Coogler left, Trump took advantage of the situation and arranged for Stephen Milan, the current chairman of the White House Economic Advisory www.xmspot.committee, to fill the vacant position. Stephen Milan is very likely to support a rate cut when the next Fed rate decision votes. With a total of 12 voters, more people will tend to cut interest rates.

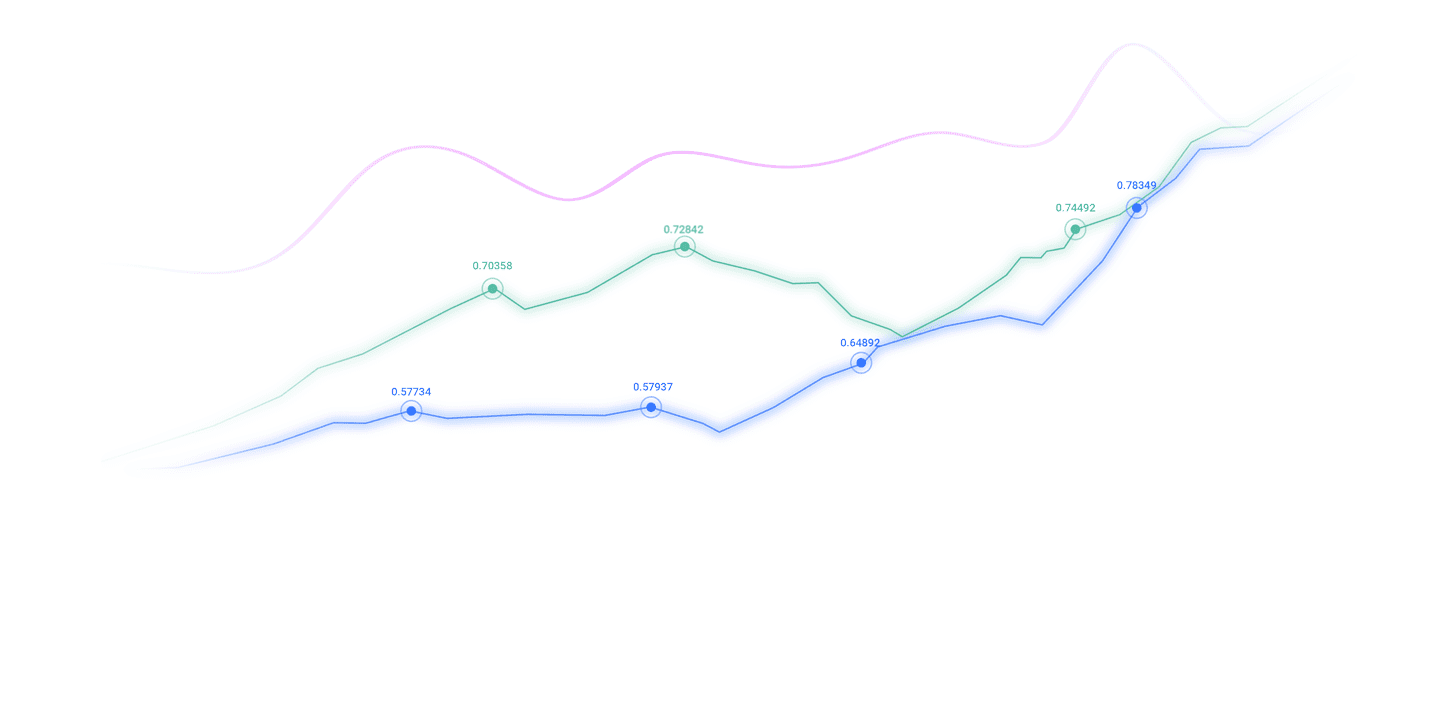

▲XM chart

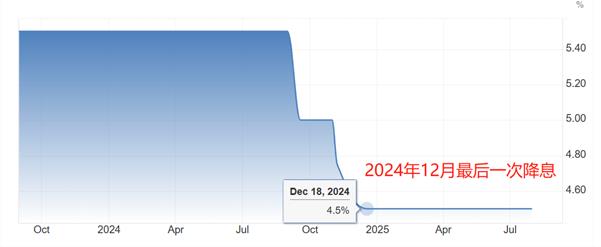

Feder Chairman Powell has a firm will and has always insisted on not cutting interest rates on the grounds of potential high inflation. However, a month before Trump entered the White House, the Federal Reserve was still maintaining its path to cut interest rates. On December 18, 2024, the Federal Reserve announced a 25 basis point interest rate cut, with the benchmark interest rate reaching 4.25~4.5%. A month later, Trump was elected as the new president, and the Federal Reserve has remained silent until now. This makes people wonder that the Fed may have chosen not to cut interest rates because of some political stance. Of course, Powell's explanation is that Trump's tariff policy may be the fuse to ignite inflation data, and it is necessary to maintain high interest rates until there is no definite evidence that tariffs will not push up inflation.

▲XM chart

The reality is that the U.S. labor market is upset. The non-farm employment report in July showed that the non-farm employment population after the season adjustment was only 73,000, far lower than the previous value of 147,000 (14,000 after the correction), and lower than the expected value of 110,000. The U.S. unemployment rate rose from 4.1% to 4.2%. Regardless of whether the U.S. inflation data will soar due to tariff policies in the future, at this stage, the U.S. labor market has shown signs of weakness due to high interest rates. One of the Fed's dual tasks is to maintain the stability of the labor market. If the Fed adheres to a high interest rate policy, the non-farm employment population may decline month by month, and the unemployment rate It is also possible to approach the 5% warning line.

Trump has two choices. The first is to force Powell to resign, and the second is to wait until Powell's term expires to re-nominate the Federal Reserve Chairman. In the past few months, Trump obviously planned to use the first method, so the problem of overspending the renovation of the Federal Reserve headquarters building was overspent. Trump said that renovation projects only cost tens of millions of dollars, and there is no need to reach more than two billion dollars. It seems reasonable to dismiss Powell on the grounds of "grave negligence". However, former Federal Reserve Chairman Yellen publicly stated that the independence of the Federal Reserve is very important, and Trump's dismissal of Powell is not worth the cost. Vice President Vance and Treasury Secretary Becent also changed his attitude , want to give up the first method.

Now, Trump still criticizes the Federal Reserve and Powell, but no longer mentions the content of dismissing Powell. It can be seen that Trump wants to take the second route and nominates a new Federal Reserve Chairman after May next year. In order to prevent the new chairman from following Powell's imitation, he will definitely conduct strict screening among the candidates. Only those who are determined to cut interest rates may be nominated. Therefore, we believe that no matter who is elected as the next Federal Reserve Chairman, he will choose to cut interest rates intensively.

XM Risk Warning, Disclaimer, Special Statement: The market is risky, and investment should be cautious. The above content only represents the points The analyst's personal opinion does not constitute any operational advice. Please do not regard this report as the only reference basis. In different periods, analysts' views may change, and the update will not be notified separately.

The above content is all about "[XM Foreign Exchange Decision Analysis]: No matter who is elected as the next Federal Reserve Chairman, he will choose to intensively cut interest rates". It was carefully www.xmspot.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your transaction! Thanks for your support!

Share, just as simple as a gust of wind can bring refreshment, just as pure as a flower can bring fragrance. The dusty heart is gradually opening up, I understand sharing, sharing is actually so simple.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here