Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

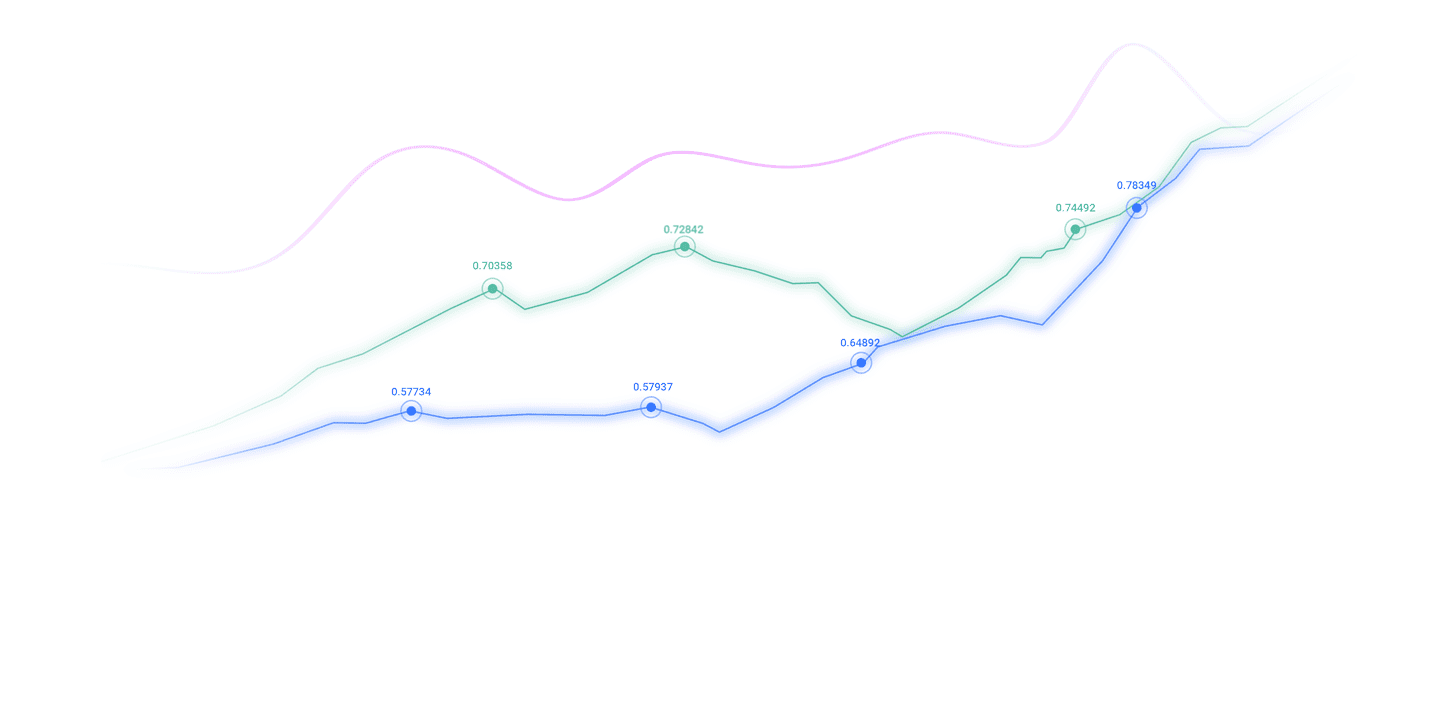

We offer a superior trading environment that puts traders in the best position to profit.

Easy Access to 1,400+ Global Assets

EURUSD

Euro vs U.S. Dollar

US500

S&P 500 (US500)

GOLD

Gold

COFFEE

US Coffee

Apple

Apple (AAPL.OQ)

-

Finance Magnates 颁发

-

Finance Magnates 颁发

-

Capital Finance International Magazine (CFI.co) 2024年颁赠

-

COLWMA 2024年颁赠

-

荣获World Finance Forex Awards 2023最佳外汇客户服务奖

-

荣获World Finance Forex Awards 2023欧洲最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023澳大拉西亚最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023拉丁美洲最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023中东最佳外汇经纪商奖

-

CFI.co于2023年颁赠

-

荣获2023年City of London Wealth Management Awards

-

荣获2022年埃及金融博览会颁赠

-

荣获2022年City of London Wealth Management Awards

-

CFI.co于2022年颁赠

-

荣获Global Forex Awards 2022 — 零售外汇 颁赠

-

2021年迪拜外汇博览会获颁赠

-

Ultimate Fintech 2021年颁赠

-

荣获2021年City of London Wealth Management Awards

-

FX168于2020年12月颁赠

-

荣获Global Business Awards 2020

-

荣获2020年City of London Wealth Management Awards

-

Capital Finance International Magazine (CFI.co)颁赠

-

Capital Finance International Magazine (CFI.co)颁赠

-

荣获2019年City of London Wealth Management Awards

-

Shares Magazine 授予 UK Forex Awards 2018

-

Capital Finance International Magazine (CFI.co)颁赠

-

Capital Finance International Magazine (CFI.co)颁赠

-

2017年伦敦财富管理奖

-

2016最佳本土 客户服务

-

中东和北非地区(MENA)增长最快的经纪商

-

2015年最佳外汇科技提供商

-

2014年最佳外汇科技提供商

-

2014年最佳外汇科技提供商

-

荣获 The Trading Show 2024年非洲 Africa Fintech 峰会颁赠

-

荣获2024年中东地区 Brokersview 颁赠

-

荣获2024年中东地区 Brokersview 颁赠

-

荣获2024年阿曼 Smart Vision 峰会颁赠

-

荣获2024年迪拜外汇博览会颁赠

-

荣获2024年迪拜 Forex Traders Summit 颁赠

-

2024年埃及 Smart Vision 峰会颁赠

-

投查查于2024年颁赠

-

Capital Finance International Magazine (CFI.co) 2024年颁赠

-

CFI.co于2023年颁赠

-

CFI.co于2023年颁赠

-

交易社区平台FOLLOWME于2022年颁赠

-

2022年迪拜Forex Expo获颁赠

-

2022年迪拜Forex Expo获颁赠

-

荣获Global Forex Awards 2022 — 零售外汇 颁赠

-

CFI.co于2022年颁赠

-

CFI.co于2022年颁赠

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

交易社区平台FOLLOWME于2021年颁赠

-

2021年埃及Smart Vision Investment Expo博览会获颁赠

-

CFI.co于2021年颁赠

-

CFI.co于2021年颁赠

-

荣获Global Forex Awards 2021 — 零售外汇 颁赠

-

荣获Global Forex Awards 2021 — 零售外汇 颁赠

-

World Finance 2021颁发

-

World Finance 2021颁发

-

FOLLOWME于2021年颁赠

-

Global Forex Awards 2021 — B2B 颁赠

-

Global Forex Awards颁赠

-

Global Forex Awards颁赠

-

CFI.co于2020年颁赠

-

CFI.co于2020年颁赠

-

荣获Global Business Awards 2020

-

World Finance Magazine 颁赠

World Finance Forex Awards 2020 -

World Finance Magazine 颁赠

World Finance Forex Awards 2020 -

FOLLOWME交易社区授予

-

Global Forex Awards颁赠

-

Global Forex Awards颁赠

-

FinTech Age Awards颁发

-

World Finance Magazine 颁赠

World Finance Forex Awards 2019 -

World Finance Magazine 颁赠

World Finance Forex Awards 2019 -

荣获 World Finance Forex Awards 2018 颁赠

-

荣获2018年埃及金融博览会颁赠

-

荣获 Shares Magazine 的 UK Forex Awards 2017 颁赠

-

荣获 World Finance Forex Awards 2017

-

2016年最佳黄金经纪商

-

2016年最佳外汇经纪商

-

2015年最佳本地客户服务

-

Global Brands Magazine 颁赠

-

Online Money Awards 2022 颁发

-

荣获2022年埃及金融博览会颁赠

-

2015最佳外汇交易平台

-

2015最佳金融交易平台

-

2013最佳创新外汇平台奖

-

2020年 Cyprus HR Awards 颁赠

-

金融行业的佼佼者

-

认证最优金牌级别

-

2014年首届亚军

-

Finance Magnates 颁发

-

Finance Magnates 颁发

-

Capital Finance International Magazine (CFI.co) 2024年颁赠

-

COLWMA 2024年颁赠

-

荣获World Finance Forex Awards 2023最佳外汇客户服务奖

-

荣获World Finance Forex Awards 2023欧洲最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023澳大拉西亚最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023拉丁美洲最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023中东最佳外汇经纪商奖

-

CFI.co于2023年颁赠

-

荣获2023年City of London Wealth Management Awards

-

荣获2022年埃及金融博览会颁赠

-

荣获2022年City of London Wealth Management Awards

-

CFI.co于2022年颁赠

-

荣获Global Forex Awards 2022 — 零售外汇 颁赠

-

2021年迪拜外汇博览会获颁赠

-

Ultimate Fintech 2021年颁赠

-

荣获2021年City of London Wealth Management Awards

-

FX168于2020年12月颁赠

-

荣获Global Business Awards 2020

-

荣获2020年City of London Wealth Management Awards

-

Capital Finance International Magazine (CFI.co)颁赠

-

Capital Finance International Magazine (CFI.co)颁赠

-

荣获2019年City of London Wealth Management Awards

-

Shares Magazine 授予 UK Forex Awards 2018

-

Capital Finance International Magazine (CFI.co)颁赠

-

Capital Finance International Magazine (CFI.co)颁赠

-

2017年伦敦财富管理奖

-

2016最佳本土 客户服务

-

中东和北非地区(MENA)增长最快的经纪商

-

2015年最佳外汇科技提供商

-

2014年最佳外汇科技提供商

-

2014年最佳外汇科技提供商

-

荣获 The Trading Show 2024年非洲 Africa Fintech 峰会颁赠

-

荣获2024年中东地区 Brokersview 颁赠

-

荣获2024年中东地区 Brokersview 颁赠

-

荣获2024年阿曼 Smart Vision 峰会颁赠

-

荣获2024年迪拜外汇博览会颁赠

-

荣获2024年迪拜 Forex Traders Summit 颁赠

-

2024年埃及 Smart Vision 峰会颁赠

-

投查查于2024年颁赠

-

Capital Finance International Magazine (CFI.co) 2024年颁赠

-

CFI.co于2023年颁赠

-

CFI.co于2023年颁赠

-

交易社区平台FOLLOWME于2022年颁赠

-

2022年迪拜Forex Expo获颁赠

-

2022年迪拜Forex Expo获颁赠

-

荣获Global Forex Awards 2022 — 零售外汇 颁赠

-

CFI.co于2022年颁赠

-

CFI.co于2022年颁赠

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

交易社区平台FOLLOWME于2021年颁赠

-

2021年埃及Smart Vision Investment Expo博览会获颁赠

-

CFI.co于2021年颁赠

-

CFI.co于2021年颁赠

-

荣获Global Forex Awards 2021 — 零售外汇 颁赠

-

荣获Global Forex Awards 2021 — 零售外汇 颁赠

-

World Finance 2021颁发

-

World Finance 2021颁发

-

FOLLOWME于2021年颁赠

-

Global Forex Awards 2021 — B2B 颁赠

-

Global Forex Awards颁赠

-

Global Forex Awards颁赠

-

CFI.co于2020年颁赠

-

CFI.co于2020年颁赠

-

荣获Global Business Awards 2020

-

World Finance Magazine 颁赠

World Finance Forex Awards 2020 -

World Finance Magazine 颁赠

World Finance Forex Awards 2020 -

FOLLOWME交易社区授予

-

Global Forex Awards颁赠

-

Global Forex Awards颁赠

-

FinTech Age Awards颁发

-

World Finance Magazine 颁赠

World Finance Forex Awards 2019 -

World Finance Magazine 颁赠

World Finance Forex Awards 2019 -

荣获 World Finance Forex Awards 2018 颁赠

-

荣获2018年埃及金融博览会颁赠

-

荣获 Shares Magazine 的 UK Forex Awards 2017 颁赠

-

荣获 World Finance Forex Awards 2017

-

2016年最佳黄金经纪商

-

2016年最佳外汇经纪商

-

2015年最佳本地客户服务

-

Global Brands Magazine 颁赠

-

Online Money Awards 2022 颁发

-

荣获2022年埃及金融博览会颁赠

-

2015最佳外汇交易平台

-

2015最佳金融交易平台

-

2013最佳创新外汇平台奖

-

2020年 Cyprus HR Awards 颁赠

-

金融行业的佼佼者

-

认证最优金牌级别

-

2014年首届亚军

-

Finance Magnates 颁发

-

Finance Magnates 颁发

-

Capital Finance International Magazine (CFI.co) 2024年颁赠

-

COLWMA 2024年颁赠

-

荣获World Finance Forex Awards 2023最佳外汇客户服务奖

-

荣获World Finance Forex Awards 2023欧洲最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023澳大拉西亚最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023拉丁美洲最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023中东最佳外汇经纪商奖

-

CFI.co于2023年颁赠

-

荣获2023年City of London Wealth Management Awards

-

荣获2022年埃及金融博览会颁赠

-

荣获2022年City of London Wealth Management Awards

-

CFI.co于2022年颁赠

-

荣获Global Forex Awards 2022 — 零售外汇 颁赠

-

2021年迪拜外汇博览会获颁赠

-

Ultimate Fintech 2021年颁赠

-

荣获2021年City of London Wealth Management Awards

-

FX168于2020年12月颁赠

-

荣获Global Business Awards 2020

-

荣获2020年City of London Wealth Management Awards

-

Capital Finance International Magazine (CFI.co)颁赠

-

Capital Finance International Magazine (CFI.co)颁赠

-

荣获2019年City of London Wealth Management Awards

-

Shares Magazine 授予 UK Forex Awards 2018

-

Capital Finance International Magazine (CFI.co)颁赠

-

Capital Finance International Magazine (CFI.co)颁赠

-

2017年伦敦财富管理奖

-

2016最佳本土 客户服务

-

中东和北非地区(MENA)增长最快的经纪商

-

2015年最佳外汇科技提供商

-

2014年最佳外汇科技提供商

-

2014年最佳外汇科技提供商

-

荣获 The Trading Show 2024年非洲 Africa Fintech 峰会颁赠

-

荣获2024年中东地区 Brokersview 颁赠

-

荣获2024年中东地区 Brokersview 颁赠

-

荣获2024年阿曼 Smart Vision 峰会颁赠

-

荣获2024年迪拜外汇博览会颁赠

-

荣获2024年迪拜 Forex Traders Summit 颁赠

-

2024年埃及 Smart Vision 峰会颁赠

-

投查查于2024年颁赠

-

Capital Finance International Magazine (CFI.co) 2024年颁赠

-

CFI.co于2023年颁赠

-

CFI.co于2023年颁赠

-

交易社区平台FOLLOWME于2022年颁赠

-

2022年迪拜Forex Expo获颁赠

-

2022年迪拜Forex Expo获颁赠

-

荣获Global Forex Awards 2022 — 零售外汇 颁赠

-

CFI.co于2022年颁赠

-

CFI.co于2022年颁赠

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

交易社区平台FOLLOWME于2021年颁赠

-

2021年埃及Smart Vision Investment Expo博览会获颁赠

-

CFI.co于2021年颁赠

-

CFI.co于2021年颁赠

-

荣获Global Forex Awards 2021 — 零售外汇 颁赠

-

荣获Global Forex Awards 2021 — 零售外汇 颁赠

-

World Finance 2021颁发

-

World Finance 2021颁发

-

FOLLOWME于2021年颁赠

-

Global Forex Awards 2021 — B2B 颁赠

-

Global Forex Awards颁赠

-

Global Forex Awards颁赠

-

CFI.co于2020年颁赠

-

CFI.co于2020年颁赠

-

荣获Global Business Awards 2020

-

World Finance Magazine 颁赠

World Finance Forex Awards 2020 -

World Finance Magazine 颁赠

World Finance Forex Awards 2020 -

FOLLOWME交易社区授予

-

Global Forex Awards颁赠

-

Global Forex Awards颁赠

-

FinTech Age Awards颁发

-

World Finance Magazine 颁赠

World Finance Forex Awards 2019 -

World Finance Magazine 颁赠

World Finance Forex Awards 2019 -

荣获 World Finance Forex Awards 2018 颁赠

-

荣获2018年埃及金融博览会颁赠

-

荣获 Shares Magazine 的 UK Forex Awards 2017 颁赠

-

荣获 World Finance Forex Awards 2017

-

2016年最佳黄金经纪商

-

2016年最佳外汇经纪商

-

2015年最佳本地客户服务

-

Global Brands Magazine 颁赠

-

Online Money Awards 2022 颁发

-

荣获2022年埃及金融博览会颁赠

-

2015最佳外汇交易平台

-

2015最佳金融交易平台

-

2013最佳创新外汇平台奖

-

2020年 Cyprus HR Awards 颁赠

-

金融行业的佼佼者

-

认证最优金牌级别

-

2014年首届亚军

-

Finance Magnates 颁发

-

Finance Magnates 颁发

-

Capital Finance International Magazine (CFI.co) 2024年颁赠

-

COLWMA 2024年颁赠

-

荣获World Finance Forex Awards 2023最佳外汇客户服务奖

-

荣获World Finance Forex Awards 2023欧洲最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023澳大拉西亚最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023拉丁美洲最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023中东最佳外汇经纪商奖

-

CFI.co于2023年颁赠

-

荣获2023年City of London Wealth Management Awards

-

荣获2022年埃及金融博览会颁赠

-

荣获2022年City of London Wealth Management Awards

-

CFI.co于2022年颁赠

-

荣获Global Forex Awards 2022 — 零售外汇 颁赠

-

2021年迪拜外汇博览会获颁赠

-

Ultimate Fintech 2021年颁赠

-

荣获2021年City of London Wealth Management Awards

-

FX168于2020年12月颁赠

-

荣获Global Business Awards 2020

-

荣获2020年City of London Wealth Management Awards

-

Capital Finance International Magazine (CFI.co)颁赠

-

Capital Finance International Magazine (CFI.co)颁赠

-

荣获2019年City of London Wealth Management Awards

-

Shares Magazine 授予 UK Forex Awards 2018

-

Capital Finance International Magazine (CFI.co)颁赠

-

Capital Finance International Magazine (CFI.co)颁赠

-

2017年伦敦财富管理奖

-

2016最佳本土 客户服务

-

中东和北非地区(MENA)增长最快的经纪商

-

2015年最佳外汇科技提供商

-

2014年最佳外汇科技提供商

-

2014年最佳外汇科技提供商

-

荣获 The Trading Show 2024年非洲 Africa Fintech 峰会颁赠

-

荣获2024年中东地区 Brokersview 颁赠

-

荣获2024年中东地区 Brokersview 颁赠

-

荣获2024年阿曼 Smart Vision 峰会颁赠

-

荣获2024年迪拜外汇博览会颁赠

-

荣获2024年迪拜 Forex Traders Summit 颁赠

-

2024年埃及 Smart Vision 峰会颁赠

-

投查查于2024年颁赠

-

Capital Finance International Magazine (CFI.co) 2024年颁赠

-

CFI.co于2023年颁赠

-

CFI.co于2023年颁赠

-

交易社区平台FOLLOWME于2022年颁赠

-

2022年迪拜Forex Expo获颁赠

-

2022年迪拜Forex Expo获颁赠

-

荣获Global Forex Awards 2022 — 零售外汇 颁赠

-

CFI.co于2022年颁赠

-

CFI.co于2022年颁赠

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

交易社区平台FOLLOWME于2021年颁赠

-

2021年埃及Smart Vision Investment Expo博览会获颁赠

-

CFI.co于2021年颁赠

-

CFI.co于2021年颁赠

-

荣获Global Forex Awards 2021 — 零售外汇 颁赠

-

荣获Global Forex Awards 2021 — 零售外汇 颁赠

-

World Finance 2021颁发

-

World Finance 2021颁发

-

FOLLOWME于2021年颁赠

-

Global Forex Awards 2021 — B2B 颁赠

-

Global Forex Awards颁赠

-

Global Forex Awards颁赠

-

CFI.co于2020年颁赠

-

CFI.co于2020年颁赠

-

荣获Global Business Awards 2020

-

World Finance Magazine 颁赠

World Finance Forex Awards 2020 -

World Finance Magazine 颁赠

World Finance Forex Awards 2020 -

FOLLOWME交易社区授予

-

Global Forex Awards颁赠

-

Global Forex Awards颁赠

-

FinTech Age Awards颁发

-

World Finance Magazine 颁赠

World Finance Forex Awards 2019 -

World Finance Magazine 颁赠

World Finance Forex Awards 2019 -

荣获 World Finance Forex Awards 2018 颁赠

-

荣获2018年埃及金融博览会颁赠

-

荣获 Shares Magazine 的 UK Forex Awards 2017 颁赠

-

荣获 World Finance Forex Awards 2017

-

2016年最佳黄金经纪商

-

2016年最佳外汇经纪商

-

2015年最佳本地客户服务

-

Global Brands Magazine 颁赠

-

Online Money Awards 2022 颁发

-

荣获2022年埃及金融博览会颁赠

-

2015最佳外汇交易平台

-

2015最佳金融交易平台

-

2013最佳创新外汇平台奖

-

2020年 Cyprus HR Awards 颁赠

-

金融行业的佼佼者

-

认证最优金牌级别

-

2014年首届亚军

Awarded BestBrokerYear After Year

CATEGORIES

News

- Seven major events to happen in the global market this week

- 7.25 Gold bottomed out and rebounded latest market trend analysis, today's long

- Chinese live lecture today's preview

- The United States and the European Union are expected to reach a tariff agreemen

- 8.6 Gold bottomed out and broke high as scheduled. Today, it was short and then

market news

Trump issued another harsh warning to Putin before the meeting, Powell may personally "spray cold water" for the rate cut in September next week

Wonderful Introduction:

Green life is full of hope, beautiful fantasy, hope for the future, and the ideal of longing is the green of life. The road we are going tomorrow is green, just like the grass on the wilderness, releasing the vitality of life.

Hello everyone, today XM Forex will bring you "[XM Group]: Trump issued a stern warning to Putin before the meeting, and Powell may personally "sink cold water" for the rate cut in September next week. Hope it will be helpful to you! The original content is as follows:

On August 14, during the Asian session on Thursday, spot gold trading around $3,360/ounce, and gold price gains were boosted by weakening the US dollar and falling US Treasury yields. Moderate U.S. inflation data consolidated expectations of the Fed's interest rate cut in September and pushed up bets on further easing later this year; U.S. crude oil trading around $62.78/barrel, oil prices fell to a new low on more than two months on Wednesday.

Data released on Tuesday showed that US consumer prices rose slightly in July, basically in line with expectations, and the transmission effect of Trump's large-scale tariffs on www.xmspot.commodity prices has been limited so far.

Investors are almost certain that the Fed will lower interest rates next month, according to data from the London Stock Exchange Group (LSEG).

U.S. Treasury Secretary Becent called for a "sequential rate cut" on Wednesday and said the Fed could start a policy easing action with a 50 basis point cut. The day before, Trump, who repeatedly criticized Fed Chairman Powell for failing to cut interest rates as soon as possible, put further pressure on him.

White House spokesman Levitt said the president is considering a lawsuit against Powell for poor management of the renovation of the Federal Reserve's Washington headquarters. "I think Washington's political level has put considerable pressure on the Fed to adjust interest rates," said Shaun Osborne, chief currency strategist at Scotiabank. "Trump also criticized Goldman Sachs CEO Su Dewei, saying it was wrong for the bank to predict that U.S. tariffs would damage the economy. Trump questioned whether Su Dewei should continue to lead Goldman Sachs.

Atlanta Federal Reserve Bank Chairman Bostic said WednesdayThe United States is close to full employment, which provides the Federal Reserve with "luxury conditions" not to rush to make any policy adjustments.

Chicago Federal Reserve Bank Chairman Goulsby said Wednesday that the Fed is working to understand whether tariffs will temporarily push up inflation or have a more sustained impact.

The weak dollar supports the euro and pound. The euro rose 0.2% against the dollar to $1.1698, reaching its highest level since July 28. The pound rose 0.5% against the dollar to $1.3567, reaching its highest level since July 24.

The UK job market has weakened again, but wage growth remains strong, highlighting the reason why the Bank of England is so cautious about rate cuts, according to data on Tuesday.

Asian Market

Australian Bureau of Statistics (ABS) released official data on Thursday showed that Australia's unemployment rate fell to 4.2% in July from 4.3% in June. This figure is lower than the market's general expectations of 4.2%.

In addition, Australia's employment changes reached 24.5K in July from 1K in June (corrected from 2K), while the market generally forecast was 25K.

Australia's participation rate stabilized at 67.0% in July, www.xmspot.compared with 67.0% in June (revised from 67.1%). Meanwhile, the number of full-time employment increased by 60.5K from the previous value of 37.6K (corrected from -38.2K). In July, part-time employment decreased by 35.9K, and the previous value increased by 40.2K.

European Market

European leaders urged Trump to put pressure on Putin to agree to a ceasefire and meet with Zelensky. According to sources, if a ceasefire agreement is reached, Ukraine's European allies "consider ease sanctions against Russia."

U.S. Market

The Trump administration is reportedly considering 11 candidates for Fed chair, including three people who have never been publicly nominated before, including David Zervos, chief market strategist at Jefferies, former Fed director Larry Lindsey and Rick Rieder, chief investment officer of BlackRock Global Fixed Income. But Trump himself said he would appoint a new Fed chairman as soon as possible, with only three to four candidates left.

Chicago Fed Chairman Goulsby: More evidence of inflation improvement is needed, and there is a possibility of action at every meeting; Fed nominee Milan: There is no evidence that tariffs trigger inflation. Traders have now fully priced the Fed to cut interest rates by 25 basis points in September.

Trump: If Russia does not stop the conflict, it will face consequences. We hope to hold a second meeting with Putin as soon as possible. If the "Tep Conference" goes well, a trilateral meeting between the United States, Russia and Ukraine will be held.

The above content is about "[XM Group]: Trump issued a stern warning to Putin before the meeting. Powell may personally "spray cold water" for the rate cut in September next week. It is carefully www.xmspot.compiled and edited by the editor of XM Forex. I hope it will be for you.The transaction helps! Thanks for the support!

Share, just as simple as a gust of wind can bring refreshment, just as pure as a flower can bring fragrance. The dusty heart gradually opened, and I learned to share, sharing is actually so simple.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

Related News

- The GBP USD technology has shown a "golden cross" and is wary of breaking throug2025-08-15

- EIA crude oil inventories hit, with expected decline narrowing to 1.565 million 2025-07-23

- Gold successfully hits a record high again, and continues to maintain the trend 2025-09-02

- US judge rejects request to disclose Fed interest rate meeting to the public2025-07-30

- Bearish pressure intensifies after the US dollar index falls below the 50-day mo2025-08-13