Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

We offer a superior trading environment that puts traders in the best position to profit.

Easy Access to 1,400+ Global Assets

EURUSD

Euro vs U.S. Dollar

US500

S&P 500 (US500)

GOLD

Gold

COFFEE

US Coffee

Apple

Apple (AAPL.OQ)

-

Finance Magnates 颁发

-

Finance Magnates 颁发

-

Capital Finance International Magazine (CFI.co) 2024年颁赠

-

COLWMA 2024年颁赠

-

荣获World Finance Forex Awards 2023最佳外汇客户服务奖

-

荣获World Finance Forex Awards 2023欧洲最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023澳大拉西亚最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023拉丁美洲最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023中东最佳外汇经纪商奖

-

CFI.co于2023年颁赠

-

荣获2023年City of London Wealth Management Awards

-

荣获2022年埃及金融博览会颁赠

-

荣获2022年City of London Wealth Management Awards

-

CFI.co于2022年颁赠

-

荣获Global Forex Awards 2022 — 零售外汇 颁赠

-

2021年迪拜外汇博览会获颁赠

-

Ultimate Fintech 2021年颁赠

-

荣获2021年City of London Wealth Management Awards

-

FX168于2020年12月颁赠

-

荣获Global Business Awards 2020

-

荣获2020年City of London Wealth Management Awards

-

Capital Finance International Magazine (CFI.co)颁赠

-

Capital Finance International Magazine (CFI.co)颁赠

-

荣获2019年City of London Wealth Management Awards

-

Shares Magazine 授予 UK Forex Awards 2018

-

Capital Finance International Magazine (CFI.co)颁赠

-

Capital Finance International Magazine (CFI.co)颁赠

-

2017年伦敦财富管理奖

-

2016最佳本土 客户服务

-

中东和北非地区(MENA)增长最快的经纪商

-

2015年最佳外汇科技提供商

-

2014年最佳外汇科技提供商

-

2014年最佳外汇科技提供商

-

荣获 The Trading Show 2024年非洲 Africa Fintech 峰会颁赠

-

荣获2024年中东地区 Brokersview 颁赠

-

荣获2024年中东地区 Brokersview 颁赠

-

荣获2024年阿曼 Smart Vision 峰会颁赠

-

荣获2024年迪拜外汇博览会颁赠

-

荣获2024年迪拜 Forex Traders Summit 颁赠

-

2024年埃及 Smart Vision 峰会颁赠

-

投查查于2024年颁赠

-

Capital Finance International Magazine (CFI.co) 2024年颁赠

-

CFI.co于2023年颁赠

-

CFI.co于2023年颁赠

-

交易社区平台FOLLOWME于2022年颁赠

-

2022年迪拜Forex Expo获颁赠

-

2022年迪拜Forex Expo获颁赠

-

荣获Global Forex Awards 2022 — 零售外汇 颁赠

-

CFI.co于2022年颁赠

-

CFI.co于2022年颁赠

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

交易社区平台FOLLOWME于2021年颁赠

-

2021年埃及Smart Vision Investment Expo博览会获颁赠

-

CFI.co于2021年颁赠

-

CFI.co于2021年颁赠

-

荣获Global Forex Awards 2021 — 零售外汇 颁赠

-

荣获Global Forex Awards 2021 — 零售外汇 颁赠

-

World Finance 2021颁发

-

World Finance 2021颁发

-

FOLLOWME于2021年颁赠

-

Global Forex Awards 2021 — B2B 颁赠

-

Global Forex Awards颁赠

-

Global Forex Awards颁赠

-

CFI.co于2020年颁赠

-

CFI.co于2020年颁赠

-

荣获Global Business Awards 2020

-

World Finance Magazine 颁赠

World Finance Forex Awards 2020 -

World Finance Magazine 颁赠

World Finance Forex Awards 2020 -

FOLLOWME交易社区授予

-

Global Forex Awards颁赠

-

Global Forex Awards颁赠

-

FinTech Age Awards颁发

-

World Finance Magazine 颁赠

World Finance Forex Awards 2019 -

World Finance Magazine 颁赠

World Finance Forex Awards 2019 -

荣获 World Finance Forex Awards 2018 颁赠

-

荣获2018年埃及金融博览会颁赠

-

荣获 Shares Magazine 的 UK Forex Awards 2017 颁赠

-

荣获 World Finance Forex Awards 2017

-

2016年最佳黄金经纪商

-

2016年最佳外汇经纪商

-

2015年最佳本地客户服务

-

Global Brands Magazine 颁赠

-

Online Money Awards 2022 颁发

-

荣获2022年埃及金融博览会颁赠

-

2015最佳外汇交易平台

-

2015最佳金融交易平台

-

2013最佳创新外汇平台奖

-

2020年 Cyprus HR Awards 颁赠

-

金融行业的佼佼者

-

认证最优金牌级别

-

2014年首届亚军

-

Finance Magnates 颁发

-

Finance Magnates 颁发

-

Capital Finance International Magazine (CFI.co) 2024年颁赠

-

COLWMA 2024年颁赠

-

荣获World Finance Forex Awards 2023最佳外汇客户服务奖

-

荣获World Finance Forex Awards 2023欧洲最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023澳大拉西亚最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023拉丁美洲最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023中东最佳外汇经纪商奖

-

CFI.co于2023年颁赠

-

荣获2023年City of London Wealth Management Awards

-

荣获2022年埃及金融博览会颁赠

-

荣获2022年City of London Wealth Management Awards

-

CFI.co于2022年颁赠

-

荣获Global Forex Awards 2022 — 零售外汇 颁赠

-

2021年迪拜外汇博览会获颁赠

-

Ultimate Fintech 2021年颁赠

-

荣获2021年City of London Wealth Management Awards

-

FX168于2020年12月颁赠

-

荣获Global Business Awards 2020

-

荣获2020年City of London Wealth Management Awards

-

Capital Finance International Magazine (CFI.co)颁赠

-

Capital Finance International Magazine (CFI.co)颁赠

-

荣获2019年City of London Wealth Management Awards

-

Shares Magazine 授予 UK Forex Awards 2018

-

Capital Finance International Magazine (CFI.co)颁赠

-

Capital Finance International Magazine (CFI.co)颁赠

-

2017年伦敦财富管理奖

-

2016最佳本土 客户服务

-

中东和北非地区(MENA)增长最快的经纪商

-

2015年最佳外汇科技提供商

-

2014年最佳外汇科技提供商

-

2014年最佳外汇科技提供商

-

荣获 The Trading Show 2024年非洲 Africa Fintech 峰会颁赠

-

荣获2024年中东地区 Brokersview 颁赠

-

荣获2024年中东地区 Brokersview 颁赠

-

荣获2024年阿曼 Smart Vision 峰会颁赠

-

荣获2024年迪拜外汇博览会颁赠

-

荣获2024年迪拜 Forex Traders Summit 颁赠

-

2024年埃及 Smart Vision 峰会颁赠

-

投查查于2024年颁赠

-

Capital Finance International Magazine (CFI.co) 2024年颁赠

-

CFI.co于2023年颁赠

-

CFI.co于2023年颁赠

-

交易社区平台FOLLOWME于2022年颁赠

-

2022年迪拜Forex Expo获颁赠

-

2022年迪拜Forex Expo获颁赠

-

荣获Global Forex Awards 2022 — 零售外汇 颁赠

-

CFI.co于2022年颁赠

-

CFI.co于2022年颁赠

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

交易社区平台FOLLOWME于2021年颁赠

-

2021年埃及Smart Vision Investment Expo博览会获颁赠

-

CFI.co于2021年颁赠

-

CFI.co于2021年颁赠

-

荣获Global Forex Awards 2021 — 零售外汇 颁赠

-

荣获Global Forex Awards 2021 — 零售外汇 颁赠

-

World Finance 2021颁发

-

World Finance 2021颁发

-

FOLLOWME于2021年颁赠

-

Global Forex Awards 2021 — B2B 颁赠

-

Global Forex Awards颁赠

-

Global Forex Awards颁赠

-

CFI.co于2020年颁赠

-

CFI.co于2020年颁赠

-

荣获Global Business Awards 2020

-

World Finance Magazine 颁赠

World Finance Forex Awards 2020 -

World Finance Magazine 颁赠

World Finance Forex Awards 2020 -

FOLLOWME交易社区授予

-

Global Forex Awards颁赠

-

Global Forex Awards颁赠

-

FinTech Age Awards颁发

-

World Finance Magazine 颁赠

World Finance Forex Awards 2019 -

World Finance Magazine 颁赠

World Finance Forex Awards 2019 -

荣获 World Finance Forex Awards 2018 颁赠

-

荣获2018年埃及金融博览会颁赠

-

荣获 Shares Magazine 的 UK Forex Awards 2017 颁赠

-

荣获 World Finance Forex Awards 2017

-

2016年最佳黄金经纪商

-

2016年最佳外汇经纪商

-

2015年最佳本地客户服务

-

Global Brands Magazine 颁赠

-

Online Money Awards 2022 颁发

-

荣获2022年埃及金融博览会颁赠

-

2015最佳外汇交易平台

-

2015最佳金融交易平台

-

2013最佳创新外汇平台奖

-

2020年 Cyprus HR Awards 颁赠

-

金融行业的佼佼者

-

认证最优金牌级别

-

2014年首届亚军

-

Finance Magnates 颁发

-

Finance Magnates 颁发

-

Capital Finance International Magazine (CFI.co) 2024年颁赠

-

COLWMA 2024年颁赠

-

荣获World Finance Forex Awards 2023最佳外汇客户服务奖

-

荣获World Finance Forex Awards 2023欧洲最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023澳大拉西亚最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023拉丁美洲最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023中东最佳外汇经纪商奖

-

CFI.co于2023年颁赠

-

荣获2023年City of London Wealth Management Awards

-

荣获2022年埃及金融博览会颁赠

-

荣获2022年City of London Wealth Management Awards

-

CFI.co于2022年颁赠

-

荣获Global Forex Awards 2022 — 零售外汇 颁赠

-

2021年迪拜外汇博览会获颁赠

-

Ultimate Fintech 2021年颁赠

-

荣获2021年City of London Wealth Management Awards

-

FX168于2020年12月颁赠

-

荣获Global Business Awards 2020

-

荣获2020年City of London Wealth Management Awards

-

Capital Finance International Magazine (CFI.co)颁赠

-

Capital Finance International Magazine (CFI.co)颁赠

-

荣获2019年City of London Wealth Management Awards

-

Shares Magazine 授予 UK Forex Awards 2018

-

Capital Finance International Magazine (CFI.co)颁赠

-

Capital Finance International Magazine (CFI.co)颁赠

-

2017年伦敦财富管理奖

-

2016最佳本土 客户服务

-

中东和北非地区(MENA)增长最快的经纪商

-

2015年最佳外汇科技提供商

-

2014年最佳外汇科技提供商

-

2014年最佳外汇科技提供商

-

荣获 The Trading Show 2024年非洲 Africa Fintech 峰会颁赠

-

荣获2024年中东地区 Brokersview 颁赠

-

荣获2024年中东地区 Brokersview 颁赠

-

荣获2024年阿曼 Smart Vision 峰会颁赠

-

荣获2024年迪拜外汇博览会颁赠

-

荣获2024年迪拜 Forex Traders Summit 颁赠

-

2024年埃及 Smart Vision 峰会颁赠

-

投查查于2024年颁赠

-

Capital Finance International Magazine (CFI.co) 2024年颁赠

-

CFI.co于2023年颁赠

-

CFI.co于2023年颁赠

-

交易社区平台FOLLOWME于2022年颁赠

-

2022年迪拜Forex Expo获颁赠

-

2022年迪拜Forex Expo获颁赠

-

荣获Global Forex Awards 2022 — 零售外汇 颁赠

-

CFI.co于2022年颁赠

-

CFI.co于2022年颁赠

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

交易社区平台FOLLOWME于2021年颁赠

-

2021年埃及Smart Vision Investment Expo博览会获颁赠

-

CFI.co于2021年颁赠

-

CFI.co于2021年颁赠

-

荣获Global Forex Awards 2021 — 零售外汇 颁赠

-

荣获Global Forex Awards 2021 — 零售外汇 颁赠

-

World Finance 2021颁发

-

World Finance 2021颁发

-

FOLLOWME于2021年颁赠

-

Global Forex Awards 2021 — B2B 颁赠

-

Global Forex Awards颁赠

-

Global Forex Awards颁赠

-

CFI.co于2020年颁赠

-

CFI.co于2020年颁赠

-

荣获Global Business Awards 2020

-

World Finance Magazine 颁赠

World Finance Forex Awards 2020 -

World Finance Magazine 颁赠

World Finance Forex Awards 2020 -

FOLLOWME交易社区授予

-

Global Forex Awards颁赠

-

Global Forex Awards颁赠

-

FinTech Age Awards颁发

-

World Finance Magazine 颁赠

World Finance Forex Awards 2019 -

World Finance Magazine 颁赠

World Finance Forex Awards 2019 -

荣获 World Finance Forex Awards 2018 颁赠

-

荣获2018年埃及金融博览会颁赠

-

荣获 Shares Magazine 的 UK Forex Awards 2017 颁赠

-

荣获 World Finance Forex Awards 2017

-

2016年最佳黄金经纪商

-

2016年最佳外汇经纪商

-

2015年最佳本地客户服务

-

Global Brands Magazine 颁赠

-

Online Money Awards 2022 颁发

-

荣获2022年埃及金融博览会颁赠

-

2015最佳外汇交易平台

-

2015最佳金融交易平台

-

2013最佳创新外汇平台奖

-

2020年 Cyprus HR Awards 颁赠

-

金融行业的佼佼者

-

认证最优金牌级别

-

2014年首届亚军

-

Finance Magnates 颁发

-

Finance Magnates 颁发

-

Capital Finance International Magazine (CFI.co) 2024年颁赠

-

COLWMA 2024年颁赠

-

荣获World Finance Forex Awards 2023最佳外汇客户服务奖

-

荣获World Finance Forex Awards 2023欧洲最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023澳大拉西亚最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023拉丁美洲最佳外汇经纪商奖

-

荣获World Finance Forex Awards 2023中东最佳外汇经纪商奖

-

CFI.co于2023年颁赠

-

荣获2023年City of London Wealth Management Awards

-

荣获2022年埃及金融博览会颁赠

-

荣获2022年City of London Wealth Management Awards

-

CFI.co于2022年颁赠

-

荣获Global Forex Awards 2022 — 零售外汇 颁赠

-

2021年迪拜外汇博览会获颁赠

-

Ultimate Fintech 2021年颁赠

-

荣获2021年City of London Wealth Management Awards

-

FX168于2020年12月颁赠

-

荣获Global Business Awards 2020

-

荣获2020年City of London Wealth Management Awards

-

Capital Finance International Magazine (CFI.co)颁赠

-

Capital Finance International Magazine (CFI.co)颁赠

-

荣获2019年City of London Wealth Management Awards

-

Shares Magazine 授予 UK Forex Awards 2018

-

Capital Finance International Magazine (CFI.co)颁赠

-

Capital Finance International Magazine (CFI.co)颁赠

-

2017年伦敦财富管理奖

-

2016最佳本土 客户服务

-

中东和北非地区(MENA)增长最快的经纪商

-

2015年最佳外汇科技提供商

-

2014年最佳外汇科技提供商

-

2014年最佳外汇科技提供商

-

荣获 The Trading Show 2024年非洲 Africa Fintech 峰会颁赠

-

荣获2024年中东地区 Brokersview 颁赠

-

荣获2024年中东地区 Brokersview 颁赠

-

荣获2024年阿曼 Smart Vision 峰会颁赠

-

荣获2024年迪拜外汇博览会颁赠

-

荣获2024年迪拜 Forex Traders Summit 颁赠

-

2024年埃及 Smart Vision 峰会颁赠

-

投查查于2024年颁赠

-

Capital Finance International Magazine (CFI.co) 2024年颁赠

-

CFI.co于2023年颁赠

-

CFI.co于2023年颁赠

-

交易社区平台FOLLOWME于2022年颁赠

-

2022年迪拜Forex Expo获颁赠

-

2022年迪拜Forex Expo获颁赠

-

荣获Global Forex Awards 2022 — 零售外汇 颁赠

-

CFI.co于2022年颁赠

-

CFI.co于2022年颁赠

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

World Finance Forex Awards 2022 颁发

-

交易社区平台FOLLOWME于2021年颁赠

-

2021年埃及Smart Vision Investment Expo博览会获颁赠

-

CFI.co于2021年颁赠

-

CFI.co于2021年颁赠

-

荣获Global Forex Awards 2021 — 零售外汇 颁赠

-

荣获Global Forex Awards 2021 — 零售外汇 颁赠

-

World Finance 2021颁发

-

World Finance 2021颁发

-

FOLLOWME于2021年颁赠

-

Global Forex Awards 2021 — B2B 颁赠

-

Global Forex Awards颁赠

-

Global Forex Awards颁赠

-

CFI.co于2020年颁赠

-

CFI.co于2020年颁赠

-

荣获Global Business Awards 2020

-

World Finance Magazine 颁赠

World Finance Forex Awards 2020 -

World Finance Magazine 颁赠

World Finance Forex Awards 2020 -

FOLLOWME交易社区授予

-

Global Forex Awards颁赠

-

Global Forex Awards颁赠

-

FinTech Age Awards颁发

-

World Finance Magazine 颁赠

World Finance Forex Awards 2019 -

World Finance Magazine 颁赠

World Finance Forex Awards 2019 -

荣获 World Finance Forex Awards 2018 颁赠

-

荣获2018年埃及金融博览会颁赠

-

荣获 Shares Magazine 的 UK Forex Awards 2017 颁赠

-

荣获 World Finance Forex Awards 2017

-

2016年最佳黄金经纪商

-

2016年最佳外汇经纪商

-

2015年最佳本地客户服务

-

Global Brands Magazine 颁赠

-

Online Money Awards 2022 颁发

-

荣获2022年埃及金融博览会颁赠

-

2015最佳外汇交易平台

-

2015最佳金融交易平台

-

2013最佳创新外汇平台奖

-

2020年 Cyprus HR Awards 颁赠

-

金融行业的佼佼者

-

认证最优金牌级别

-

2014年首届亚军

Awarded BestBrokerYear After Year

CATEGORIES

News

- When is a head for gold fluctuation? Follow 3355-3325 tonight, ;;

- Gold successfully hits a record high again, and continues to maintain the trend

- Gold has broken through dawn and space is expected!

- A collection of positive and negative news that affects the foreign exchange mar

- French politics votes to determine life and death next week, euro bulls tremble

market analysis

8.7 Gold was perfectly taken by all yesterday, and the 80-stop area was first in the morning trading today

Wonderful introduction:

Optimism is the line of egrets that are straight up to the blue sky, optimism is the thousands of white sails beside the sunken boat, optimism is the lush grass that blows with the wind on the head of the parrot island, optimism is the falling red spots that turn into spring mud to protect the flowers.

Hello everyone, today XM Forex will bring you "[XM Group]: 8.7 gold was perfectly taken yesterday, and the 80-stop area was the first in the morning trading today." Hope it will be helpful to you! The original content is as follows:

Your profit often www.xmspot.comes from the losses of others. Every price fluctuation is hidden in the judgment deviations of market participants and the decision-making mistakes. However, we cannot predict who will make mistakes in the next moment, nor can we guarantee that we will always be on the right side. In this game, the only controllable thing is how to control the losses to the minimum range when you make a mistake. The essence of trading is to wait for others' mistakes through constant trial and error, and to capture profit opportunities from them.

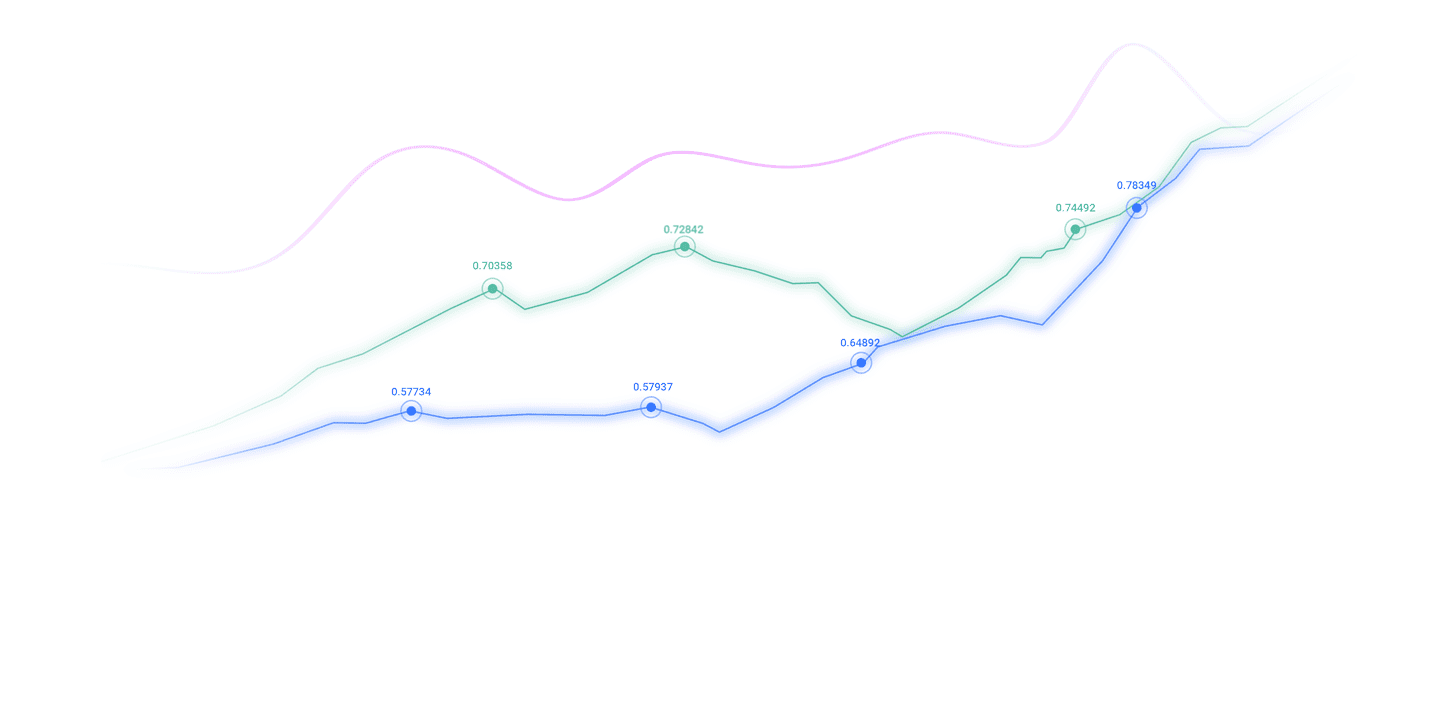

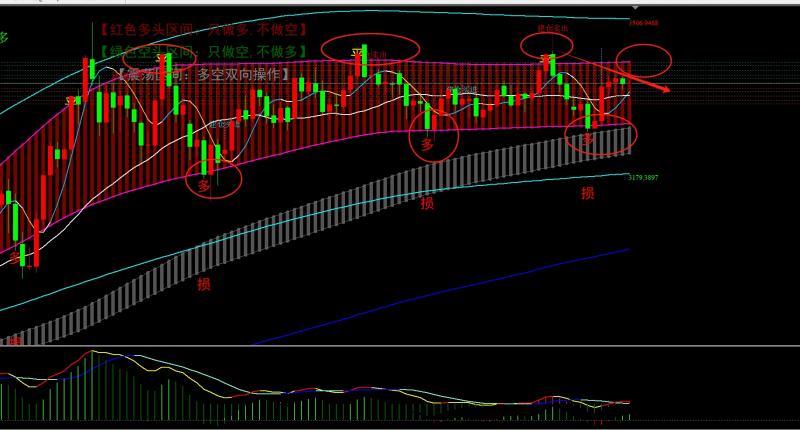

Yesterday, gold was the same as the height of the early review and European session analysis. The price fell directly at 85.2. We fell back at 82.3 and entered short. The European Review gave a second rebound of 77-78 short, giving a target of 68-57. The long on the first order of 58 was also perfectly pulled to 80. The overall long and short were perfectly connected throughout the day, and the profit was locked in the pocket again.

Today, the upward trend of the daily chart has not changed, and the price is still running above the moving average, but it is a bit meaningful to close three small crosses K at a high level. At the same time, the side pressure at the high point of 3438.5 also appears. There are two situations like this: one is a turning point, and the other is to accumulate momentum. Now we don’t need to give a dead position, keeping the bulls above 3345 and ending the rebound below. The upper part continues to look at the upper line of the daily chart at 3415, and the short-term suppression is the side pressure 3381-82 here, which means that the bottoming out and rebounding is treated according to the principle of breakthrough.The early rebound is the above. The defense is short-short below. The price is now running between the upper and lower lines in four hours. The span is relatively large, and the meaning is not much. The span distance between the two sides is not much. So based on several cycles, we will continue to short first and then long today. Break through the side pressure and follow the trend. If we give the bottom line, we will defend it even more. We will not chase the higher at a high level and then add a few dozen losses. When the rise is still boasting that it will rise sharply. If it loses and rises to 5,000, it has nothing to do with you. So everyone grasps a principle. The current market is a wide fluctuating market, not a market that rose by 100 a day in the previous period. If you look long, there is no longer a 30-dollar range. On the contrary, the same is true. Besides, your funds have a few stop loss of 30 US dollars. Many people think that the ability to trade is to look at the right market, be able to accurately judge the trend, seize the opportunity, and predict the turning point in advance. But the operating mechanism of the market never depends on understanding. What you see is the graph, the market operates in structural games; what you understand is the news, the market reacts to expectations; what you think is logic, and the market jumps in liquidity constraints. A truly mature trader is not trying to see through the market, but knowing that the market cannot be fully understood and can only half-solve, so he turns to identifying its potential energy structure. He has been too much trouble. The www.xmspot.comprehensive idea for today's Asian market is as follows: mainly short.

With 3384 as the defense, first empty around 80, look at 60-54-45, once the loss is lost, it will break through the side pressure, and then fall back and www.xmspot.combine with the market with a lot of the market. For more 45, the defense will be treated by the relay, break 40 and leave, and then continue to look at 3360-70. Behind the rebound, end the rebound.

Pound Day: Make the range, sell high and low between 196.15-198, and each defends 60 points.

Pound and US: Oversold rebound, pay attention to the 1.3300 line to rebound during the day, and defend 40 points.

Oil: Short near 64.5, loss 65, look at 63.5

The above ideas are for reference. The market is risky, so be cautious when investing.

Trading is for profit, not for being angry or for trading, so traders must understand what actions the price is at! Traders are not eternal longs, nor are they eternal shorts. Traders are always changing with the changes in the market! Traders must have their own defense system to control risks! Risk control and fund management must be available in your transactions!

The above content is all about "[XM Group]: 8.7 gold was perfectly taken all yesterday, and the 80 area was short in the morning trading today". It was carefully www.xmspot.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Spring, summer, autumn and winter, every season is a beautiful scenery, and it stays in my heart forever. Leave~~~

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

Related News

- A collection of positive and negative news that affects the foreign exchange mar2025-09-01

- The prospect of external interest rate cuts is clear, and the Hang Seng Index hi2025-08-25

- The replacement of the head of the Bureau of Labor Statistics has caused controv2025-08-14

- Oil prices rose by more than 3%, gold price 3330 mark is waiting for Federal Res2025-07-30

- Gold continues to fluctuate upward, and there is a rebound and it will be more!2025-08-05