Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Large energy order of US$750 billion! How the U.S.-European Trade Agreement Resh

- Gold, 3400 stations are not difficult!

- Continue to go down, 3359 is the key to long and short!

- Shigeru Ishiba was forced to palace within the party, and the US dollar maintain

- A collection of positive and negative news that affects the foreign exchange mar

market news

The expectation of interest rate cuts is favorable to gold. Can the technical side be driven by the technology?

Wonderful Introduction:

Only by setting off can you reach your ideals and destinations, only by working hard can you achieve brilliant success, and only by sowing can you gain. Only by pursuing can one taste a dignified person.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Analysis]: The expectation of interest rate cuts is more beneficial to gold, can the technical side be promoted relay?" Hope it will be helpful to you! The original content is as follows:

On Tuesday (August 5), spot gold fell into a sideways fluctuation after rebounding strongly for three consecutive days. The trading was around $3,375 during the European period, and the short-term trend showed a tug-of-war. The slight rebound of the US dollar index suppressed gold prices, but market expectations of the Fed's interest rate cut in September still provide support for gold. In addition, global trade uncertainty has not yet dissipated, causing a clear decline in demand for safe-haven.

Finance:

The recent upward momentum of gold www.xmspot.comes from weak US economic data and rising expectations for interest rate cuts. The non-farm employment data released last week showed that the labor market was significantly weaker, strengthening the market's bet on the Federal Reserve's opening of a new round of interest rate cuts in September. The CMEFedWatch tool shows that the market's expectations for the probability of a rate cut in September have exceeded 90%. At the same time, U.S. factory orders fell sharply by 4.8% in June, further highlighting economic fatigue.

On the other hand, U.S. President Trump signed an executive order last week to raise tariffs on imported goods from dozens of countries, with the minimum tax rate of countries with trade deficits with the United States reaching 15%. Relevant measures are about to take effect. This uncertainty continues to interfere with global market sentiment and supports gold's risk aversion attributes.

However, the US dollar rebounded slightly, partially offsetting the upward action energy of gold. Traders will focus on the upcoming U.S. ISM service industry PMI data to determine whether the economic slowdown has spread to the service sector.

Technical:

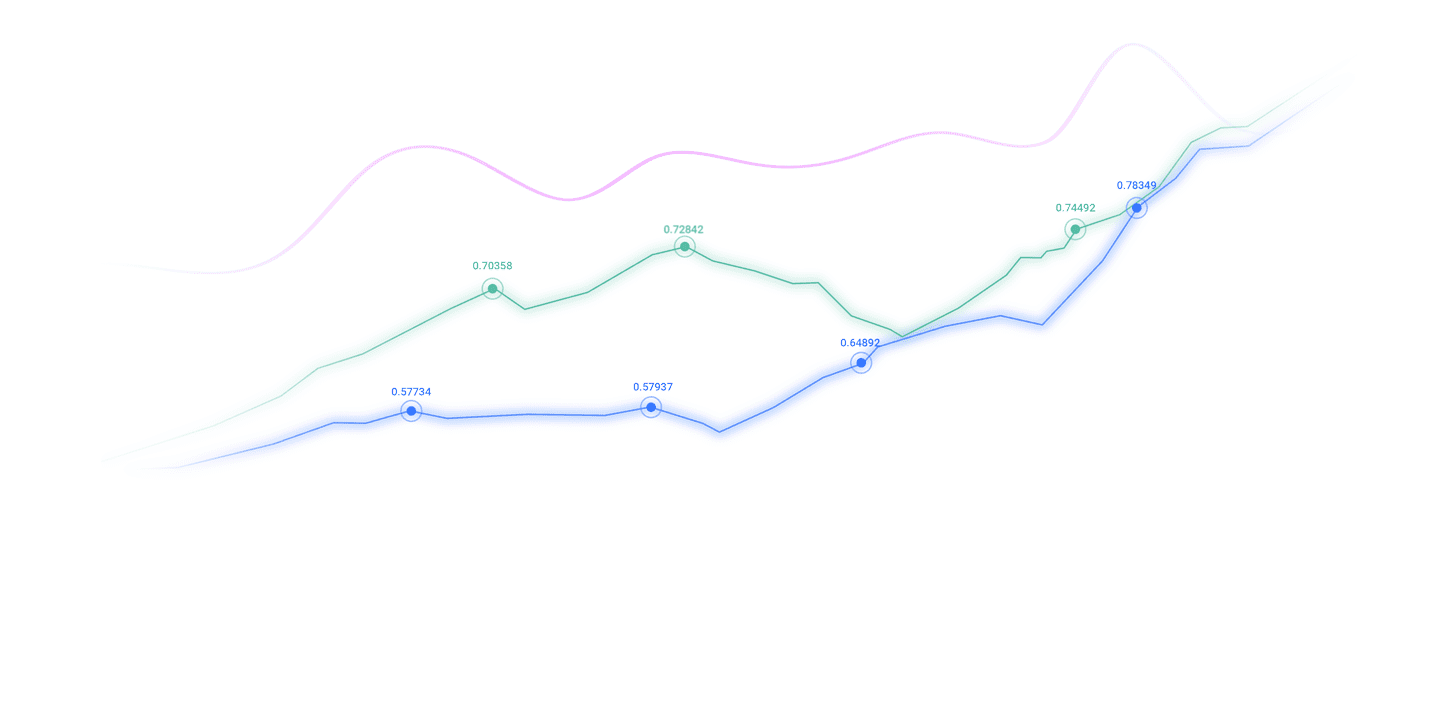

From the daily gold chart, the price has recently been between the middle rail of the Bollinger Band (3343.59) and the upper rail (3411.09), and has not effectively broken through the key resistance area. The overall trend remains within the medium-term oscillation channel, and no obvious trend direction is formed.

Recent K-line www.xmspot.combinations form a typical "swing-swing" pattern, indicating that the market has obvious pressure around the previous high of 3438.80, while the Bollinger lower rail at 3276.09 below provides support, showing a "box consolidation" pattern in the short term.

In terms of MACD indicators, the fast and slow line is running near the zero axis, DIFF and DEA are slightly golden crossed but the angle is flat, and the red column has limited momentum, indicating that the upward momentum is insufficient and a strong rebound structure has not yet been formed.

The relative strength index (RSI) remains at 54.81, which is in a relatively strong neutral area, indicating that the price lacks clear direction in the short term, and market sentiment is mainly wait-and-see. In the future, we need to pay attention to whether we stand firm above the Bollinger middle track, or fall back to the low support before the test.

Prevention of market sentiment:

The current sentiment in the gold market is cautiously optimistic. Traders have set high prices for the Fed's interest rate cut, pushing up gold's short-term rebound, but the dollar still has its resilience, limiting the upward space for gold prices. The indicators show that funds have not flowed significantly into the gold ETF, indicating that the market has not yet fully turned to defensive allocation.

Technical graphics present a typical "organization platform", indicating that the market is waiting for clearer policy or data guidance. The investment group still maintains its psychological interest in safe-haven assets, but lacks the willingness to chase high prices. In the short term, market sentiment may continue to be limited by external macro data fluctuations and policy expectations.

Future Outlook:

Bolster Perspective:

Analysts believe that if gold prices subsequently break through the upper 3411.09 line of Bollinger Bands and accompany the expansion of the MACD momentum column, it is expected to open up further upward space, with the goal of focusing on the previous high area of US$3450. If the Federal Reserve sends a clear signal of interest rate cuts, or the US economy continues to be weak, gold is expected to usher in a medium-term trend reversal and restart the upward channel.

Short perspective:

Analysts believe that if gold prices continue to be restricted from the 3400-3411 range and fall below the Bollinger middle track and moving average support, the short-term retracement trend may be launched, testing the lower track support of the US$3276. If the ISM service industry PMI is stronger than expected and the US dollar strengthens again, gold may return to bear dominance.

The above content is all about "[XM Foreign Exchange Market Analysis]: The expectation of interest rate cuts is favorable to gold, can the technical side be promoted?" is carefully www.xmspot.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Every successful person has a beginning. Only by having the courage to start can you find the way to success. Read the next article now!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here