Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The gold bulls had no power to fight back and continued to be short in the early

- Inflation expectations cool down, US dollar index retreats from 50-day moving av

- With the arrival of Trump's tariff deadline, will non-farm data show signs of fa

- Large energy order of US$750 billion! How the U.S.-European Trade Agreement Resh

- After gold hits a new high, 3466 gains and losses determine short-term strength

market news

Multiple positive effects push the US dollar, gold and silver are making high-altitude

Wonderful Introduction:

Youth is the nectar made of the blood of will and the sweat of hard work - the fragrance over time; youth is the rainbow woven with endless hope and immortal yearning - gorgeous and brilliant; youth is a wall built with eternal persistence and tenacity - as solid as a soup.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Review]: Multiple positive effects promote the US index, and gold and silver are in high altitudes." Hope it will be helpful to you! The original content is as follows:

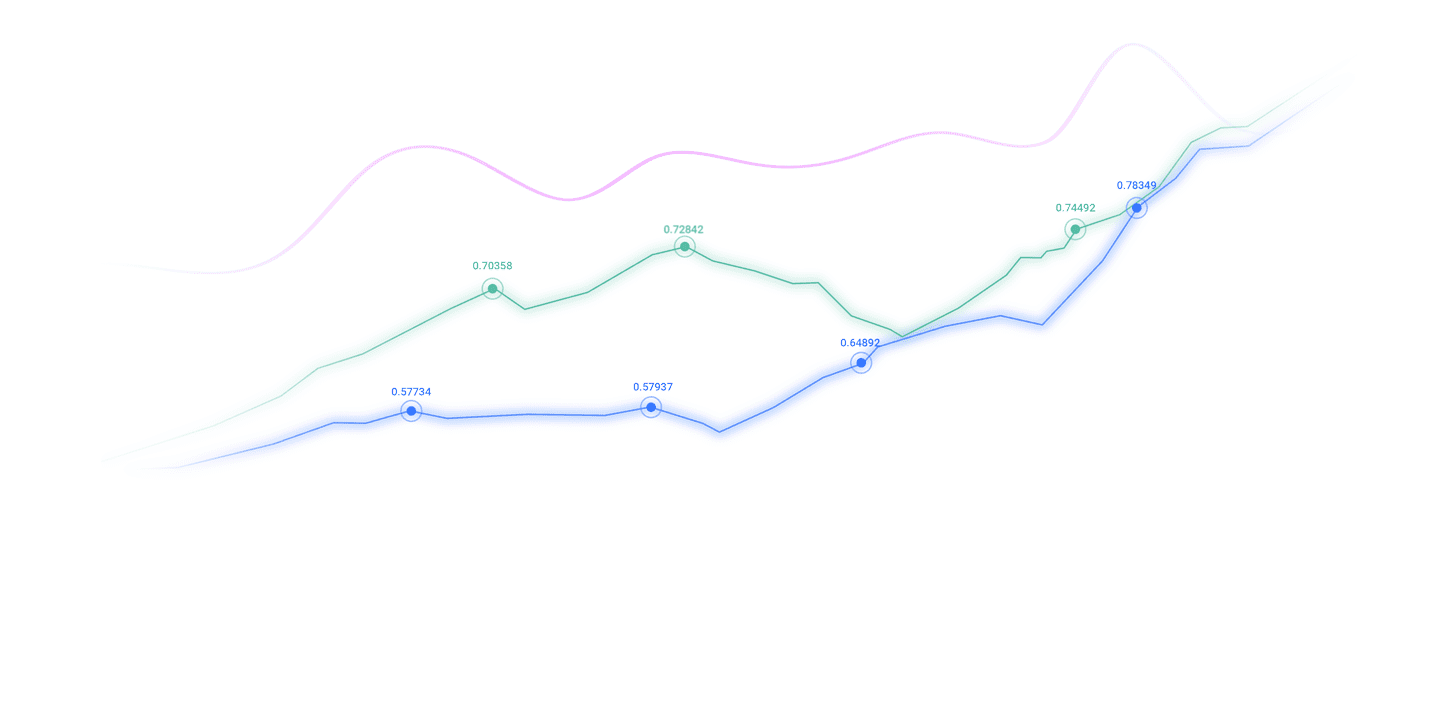

Yesterday, the gold market opened at the early trading position at 3327.4 and then the market fell slightly. The market fluctuated and rose. The daily line reached the highest position at 3334.3. After the market fell strongly due to fundamentals. The daily line was at the lowest position at 3267.9 and then sorted out. The daily line finally closed at 3274.4. Then the market closed with a large negative line with an upper and lower shadow line. After this pattern ended, today's 3296 shorts were conservative 3302. The target below looked at 3272 and 3262 and 3255-3250.

The silver market opened at 38.204 yesterday and then fell back first. The market rose rapidly. The daily line reached the highest position of 38.25 and then fell strongly. The daily line was at the lowest position of 36.77 and then rose at the end of the trading session. The daily line finally closed at 37.109. The market closed with a large negative line with a long lower shadow line. After this pattern ended, today's 37.5 short is only 37.7. The target below looks at 37.1 and 36.8 and 36.7 and 36.5-36.3.

The European and American markets opened yesterdayAfter the position of 1.15447, the market first rose and gave the position of 1.15723, and then the market fell strongly. The daily line was at the lowest point of 1.13994 and then the market consolidated. The daily line finally closed at the position of 1.14033, and the market closed with a large negative line with a long upper shadow line. After this pattern ended, today, 1.14900 short stop loss of 1.15100, the target below is 1.14300 and 1.13900, and below is 1.13600 and 1.13400.

The US crude oil market opened at 70.02 yesterday and then the market fell first. The daily line was at the lowest point of 69.12 and then the market rose strongly. The daily line reached the highest point of 71.2 and then the market consolidated. The daily line finally closed at 70.97 and then the market closed with a medium-positive line with a long lower shadow line. After this pattern ended, it stopped the loss of 69.5 today at 70.1. The target was 71 and 71.2 and 71.5 and 72-72.5.

The Nasdaq market opened at 23319.98 yesterday and then rose first to give the position of 23413.94 and then fell rapidly in the early morning. The daily line was at the lowest point of 23218.67 and then rose directly. The daily line reached the highest point of 23550.9 and then consolidated. The daily line finally closed at 23521.33. Then the market closed with a medium-sized positive line with a long lower shadow line. Line, and after the end of this pattern, the stop loss of more than 23450 today was 23390, with a target of 23550 and 23650 and 23700.

The fundamentals, yesterday's fundamentals market focused on the Fed's interest rate resolution in the early morning and the speech of the Fed Chairman. Fed Chairman Powell said that the current interest rate level is enough to cope with the continued uncertainty brought by tariffs and inflation, which has poured cold water on the market's expectations for a rate cut in September. The U.S. Treasury sell-off accelerates as Powell points out that the labor market conditions are “at equilibrium.” The dollar soared to its highest level since May, with the S&P 500 closing lower. The sharp appreciation of the dollar has triggered a panic selling of gold, causing gold prices to fall below a month-long low. However, it is worth noting that although this time it indicates that there will be a rate cut in September, directors Waller and Bowman voted against it and advocated a rate cut. This shows that the pressure on the US president within the Federal Reserve still has an impact. The extent and timing of interest rate cuts will be the key to the next Fed policy. In addition, the number of ADP employment in the United States increased by 104,000 in July, exceeding the expected 75,000, rebounding to the highest growth level since March. The U.S. economy grew by 3% in the second quarter, exceeding expectations of 2.4%. The fundamentals today are still key, focusing mainly on the number of initial unemployment claims in the United States from 20:30 to July 26 and the United States 6The annual rate of monthly core PCE price index. Watch the Chicago PMI in July at 21:45 in the United States.

In terms of operation, gold: 3296 short today is conservative 3302, the target below is 3272 and 3262 and 3255-3250.

Silver: 37.5 short today is just you 37.7, the target below is 37.1 and 36.8 and 36.7 and 36.5-36.3.

Europe and the United States: 1.14900 short stop loss today is 1.15100, the target below is 1.14300 and 1.13900, and the target below is 1.13600 and 1.134 00.

U.S. crude oil: 70.1 long stop loss 69.5 today, target 71 and 71.2 and 71.5 and 72-72.5.

Nasdaq Index: 23450 long stop loss 23390 today, target 23550 and 23650 and 23700.

The above content is all about "[XM Foreign Exchange Market Review]: Multiple positive effects push the US index, gold and silver are high in the sky", which is carefully www.xmspot.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Spring, summer, autumn and winter, every season is a beautiful scenery, and it stays in my heart forever. Leave~~~

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here