Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Five major events to happen in the global market this week

- Gold is under pressure as scheduled, Europe and the United States first pay atte

- Unexpected performance of Japan's GDP intensifies the Bank of Japan's interest r

- The weekly line is high and the hammer head is high after short gold and silver

- The "tug-of-war" after PCE data, key support levels usher in the final stress te

market analysis

ECB will suspend interest rate hikes, US PMI data will boost market volatility

Wonderful introduction:

Let your sorrows be full of worries, and you can't sleep, and you can't sleep. The full moon hangs high, scattered all over the ground. I think that the bright moon will be ruthless, and the wind and frost will fade away for thousands of years, and the passion will fade away easily. If there is love, it should have grown old with the wind. Knowing that the moon is ruthless, why do you repeatedly express your love to the bright moon?

Hello everyone, today XM Foreign Exchange will bring you "【XM Group】: The ECB will suspend interest rate hikes, and the US PMI data will boost market volatility." Hope it will be helpful to you! The original content is as follows:

Finance markets will take a break from trade-related headlines on Thursday, July 24, and keep an eye on the European Central Bank’s (ECB) monetary policy announcements. In addition, the economic calendar will also release the initial data on the manufacturing and service purchasing managers' index (PMI) for July for Germany, the euro zone, the United Kingdom and the United States.

As the market cheered on the U.S.-Japan trade agreement, risk flows dominated the market trend on Wednesday. The major Wall Street stock index rose strongly on the daily line, with the US dollar index closing in the negative territory for the fourth consecutive day. Earlier Thursday, U.S. stock index futures rose and fell, with the U.S. dollar index steady above 97.00. U.S. President Donald Trump will visit the Fed on Thursday, the White House said late Wednesday.

Asian trading hours, Australian data showed that the S&P Global www.xmspot.comprehensive Purchasing Managers Index improved from 51.6 in June to 53.6 in July, reflecting the continued accelerated expansion of private sector business activities. Meanwhile, Reserve Bank of Australia (RBA) President Michele Bullock reiterated that it is appropriate to take cautious and gradual monetary easing measures. The Australian dollar/dollar rose more than 0.7% on Wednesday and maintained bullish momentum earlier on Thursday, trading above 0.6600, the highest since November.

Basic foreign exchange market trends:

Japan's JibunBank manufacturing purchasing managers' index fell to 48.8 in July, lower than the market expectations of 50.2. On the positive side, Jibun Bank's service industry purchasing managers index rose to 53.5 from 51.7 in the current period. USD/JPY is still facingBearish pressure, Europe traded around 146.00 in the early trading, down more than 0.3% on the day.

The ECB is widely expected to keep key interest rates unchanged after its July meeting. ECB President Christina Lagarde will speak on policy prospects at a pre-session meeting that begins at 12:45 GMT. The euro/dollar remained in the consolidation phase above 1.1750 after a slight increase on Wednesday.

The GBP/USD stabilized above 1.3550 after closing sharply higher in the first three days.

During the European session Thursday, the US dollar/Canada fluctuated narrowly around 1.3600, with a weekly decline of about 1%. Later that day, Statistics Canada will release retail sales data for May.

Bulle market fundamentals:

Because risk flow dominates the market, gold has difficulty finding demand and made in-depth adjustments on Wednesday. Gold/USD continued to move lower after falling more than 1% on Wednesday, trading below $3,370.

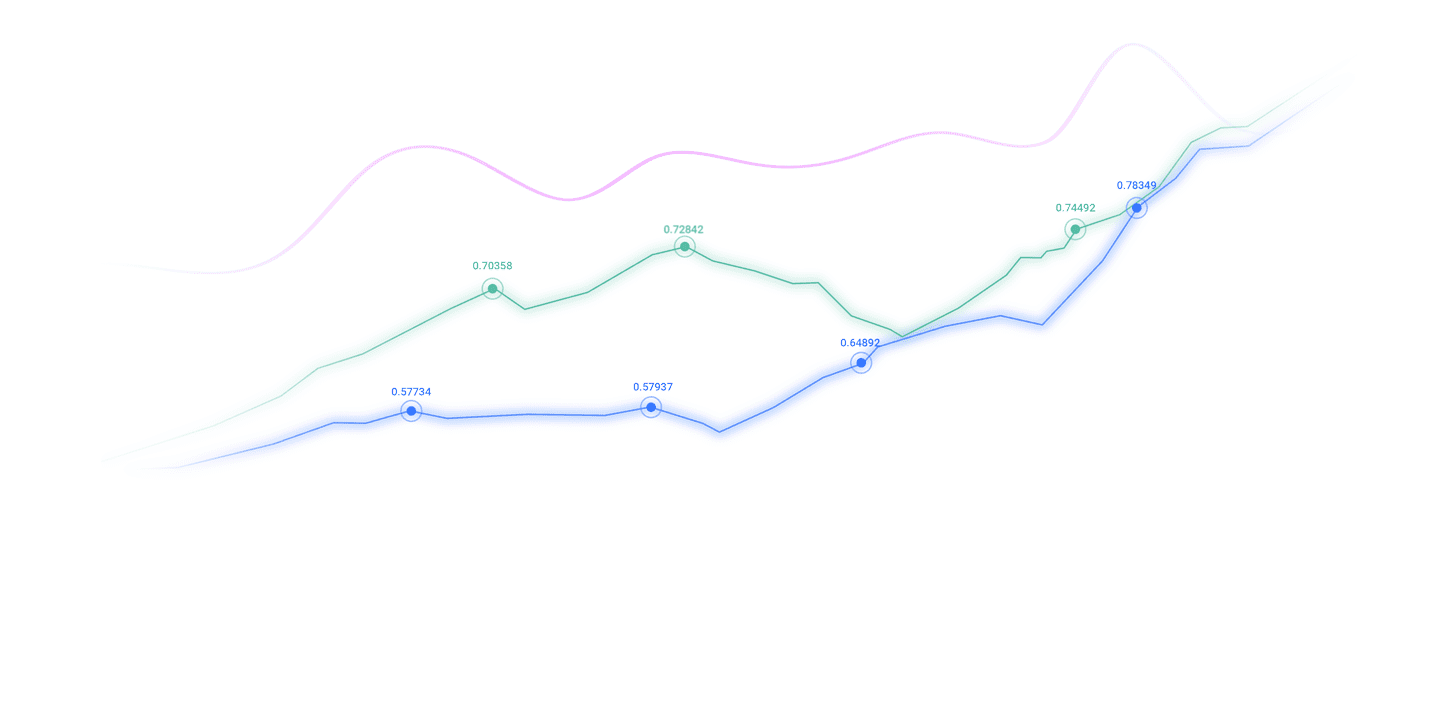

Analysis of major currency trends:

Euro: Euro/USD rebound from 1.1555 is still in progress, and it is biased toward an upward trend during the session, and the 1.1829 high is retested. A firm breakthrough will resume the overall rebound from 1.0176 and aim at the 1.1916 forecast level. However, a breakout of 1.1677 will delay the bullish situation and turn to an intraday bias towards neutral, with more consolidation first below 1.1829.

The above content is all about "【XM Group】: The ECB will suspend interest rate hikes, and the US PMI data will boost market fluctuations". It was carefully www.xmspot.compiled and edited by the editor of XM Forex. I hope it will be helpful to your transaction! Thank you for your support!

A thing you have done will always have experience and lessons. In order to facilitate future work, you must analyze, study, summarize, and concentrate the experience and lessons of your past work, and raise it to the theoretical level to understand.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here